5 Million Interest Free Loan Scheme

In a significant move to bolster economic growth and support entrepreneurs, Chief Minister Punjab, Maryam Nawaz Sharif, has introduced the ‘CM Punjab Asaan Karobar Finance Scheme‘ and the ‘Asaan Karobar Card’. These initiatives aim to provide interest-free loans to small and medium-sized enterprises (SMEs) across the province, facilitating business startups and expansions.

Quick Information Table

| Program Name | CM Punjab Asaan Karobar Finance Scheme |

| Start Date | January 16, 2025 |

| End Date | Not specified |

| Loan Amount | Up to Rs. 30 million |

| Application Method | Online |

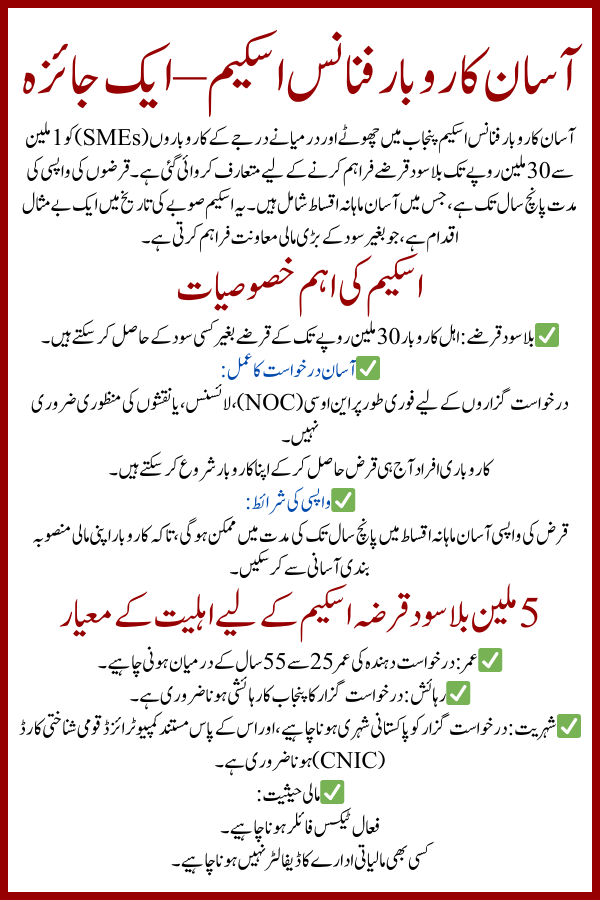

Overview of the Asaan Karobar Finance Scheme

The ‘Asaan Karobar Finance Scheme’ is designed to provide interest-free loans ranging from Rs. 1 million to Rs. 30 million to SMEs in Punjab. The repayment period extends up to five years, with easy monthly installments. This initiative is unprecedented in the province’s history, offering substantial financial support without the burden of interest.

Key Features of the Scheme

- Interest-Free Loans: Eligible businesses can access loans up to Rs. 30 million without any interest charges.

- Simplified Application Process: Applicants are not required to obtain immediate No Objection Certificates (NOCs), licenses, or approved maps. This means entrepreneurs can secure a loan today and commence their business operations promptly.

- Repayment Terms: The loans are repayable in easy monthly installments over up to five years, making it manageable for businesses to plan their finances.

Eligibility Criteria for 5 Million Interest Free Loan Scheme

To qualify for the Asaan Karobar Finance Scheme, applicants must meet the following conditions:

- Age: Between 25 and 55 years.

- Residency: Must be a resident of Punjab.

- Citizenship: Pakistani national with a valid Computerized National Identity Card (CNIC).

- Financial Standing: Should be an active tax filer and not a defaulter of any financial institution.

Application Process for 5 Million Interest Free Loan Scheme

Interested individuals can apply online through the dedicated web portal: akf.punjab.gov.pk. For assistance, a toll-free helpline is available at 1786.

Asaan Karobar Card

Alongside the finance scheme, the ‘Asaan Karobar Card’ has been introduced to support startups and small businesses. This card offers interest-free loans ranging from Rs. 500,000 to Rs. 1 million. The repayment period for these loans is up to three years, with easy monthly installments.

Key Features of the Asaan Karobar Card

- Vendor Payments: Facilitates payments to vendors for the purchase of raw materials.

- Utility Payments: Enables payment of government fees, taxes, and utility bills.

- Cash Withdrawal: Allows up to 25% cash withdrawal of the loan amount.

Eligibility Criteria for the Card

- Age: Between 21 and 57 years.

- Residency: Must be a resident of Punjab.

- Citizenship: Pakistani national with a valid CNIC and mobile number.

Application Process for the Card

Applications can be submitted online at akc.punjab.gov.pk. For guidance, applicants can contact the toll-free number 1786.

Additional Incentives

To further boost economic development, the Punjab government is offering additional incentives for setting up industries in export processing zones. Entrepreneurs establishing businesses in these zones will receive free solar systems worth up to Rs. 5 million.

Conclusion

The ‘CM Punjab Asaan Karobar Finance Scheme’ and the ‘Asaan Karobar Card’ represent groundbreaking efforts by the Punjab government to empower entrepreneurs and stimulate economic growth. By providing substantial interest-free loans and simplifying the application process, these initiatives aim to make it easier for individuals to start and expand their businesses, contributing to a prosperous future for Punjab.