Asaan Karobar Loan Scheme 2025

The Punjabi government came up with the revolutionary Asaan Karobar Loan Program 2025 to help small company owners and emerging tycoons. The program offers interest-free loans up to PKR 1 million, allowing people to launch or grow businesses without thinking about money. The project offers an entirely digital and open request process with the goal of fostering economic growth and self-reliance. This page will walk you through all the essential details, including supplies, features, and claim processes, if you’re excited about applying for this program.

Key Features of the Asaan Karobar Loan Program

This program is packed with features to ensure all-out benefit for small businesses. Below are the key highlights:

- Loan Limit: Up to PKR 1 million.

- Loan Tenure: 3 years.

- Loan Type: Revolving credit for 12 months.

- Repayment Terms: 24 equal monthly installments starting after the first year.

- Grace Period: A 3-month break from card issuance before repayments begin.

- Interest Rate: 0%, making it a completely interest-free loan.

- Usage Flexibility:

- Payments to suppliers and vendors.

- Settlement of utility bills, government fees, and taxes.

- Cash withdrawal of up to 25% of the loan limit for commercial purposes.

- Digital payments via mobile apps or POS systems.

Quick Overview of Asaan Karobar Loan Program

| Feature | Details |

| Name of Program | Asaan Karobar Loan Program |

| Start Date | January 2025 |

| End Date | December 2025 |

| Maximum Loan Amount | PKR 1 million |

| Interest Rate | 0% |

| Application Method | Online via PITB Portal |

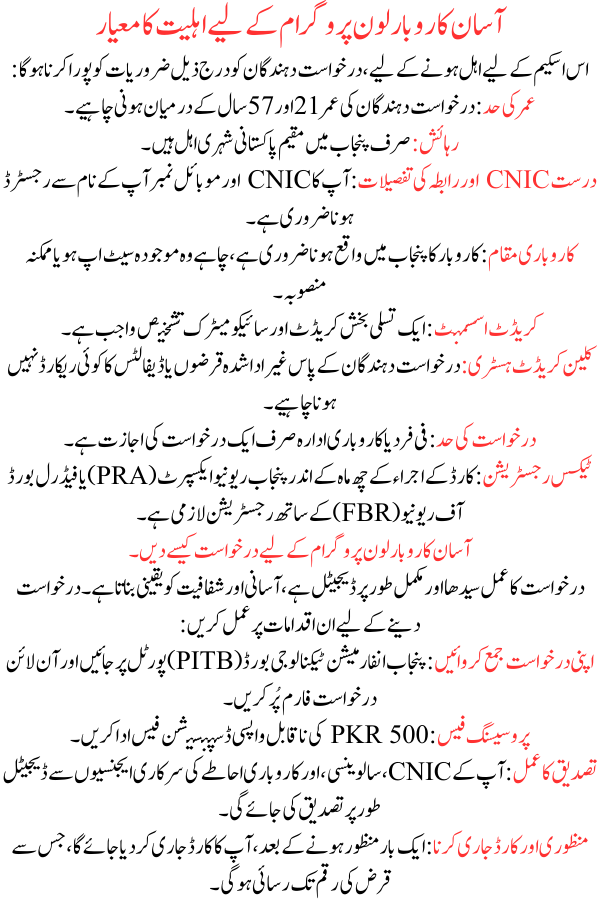

Eligibility Criteria for the Asaan Karobar Loan Program

To qualify for this scheme, applicants must meet the following requirements:

- Age Range: Applicants should be between 21 and 57 years old.

- Residency: Only Pakistani nationals residing in Punjab are eligible.

- Valid CNIC and Contact Details: Your CNIC and mobile number must be registered under your name.

- Business Location: The business must be located in Punjab, whether it’s an existing setup or a prospective venture.

- Credit Assessment: A satisfactory credit and psychometric evaluation is obligatory.

- Clean Credit History: Applicants must have no record of unpaid loans or defaults.

- Application Limit: Only one application per individual or business entity is allowed.

- Tax Registration: Registration with the Punjab Revenue Expert (PRA) or Federal Board of Revenue (FBR) is obligatory within six months of card issuance.

How to Apply for the Asaan Karobar Loan Program

The application process is straightforward and entirely digital, ensuring ease and transparency. Follow these steps to apply:

- Submit Your Application: Visit the Punjab Info Technology Board (PITB) portal and fill out the online application form.

- Processing Fee: Pay a non-refundable dispensation fee of PKR 500.

- Verification Process: Your CNIC, solvency, and business premises will be digitally verified by official agencies.

- Approval and Card Issuance: Once approved, your card will be issued, allowing access to the loan amount.

Loan Usage and Repayment Guidelines

The Asaan Karobar Loan Program has clear rules concerning loan usage and payment to promote financial discipline. Here are the key details:

| Details | Description |

| First 50% Loan Limit | Accessible within the first 6 months. |

| Grace Period | 3-month repayment holiday post card issuance. |

| Monthly Minimum Payment | 5% of the outstanding balance (principal only). |

| Second 50% Loan Limit | Released upon timely usage and repayments. |

| Repayment Term | Repayable over 2 years via equal monthly installments (EMIs). |

| Restricted Usage | Non-business-related expenses, such as personal purchases, are prohibited. |

Additional Costs and Fees

Although the scheme is interest-free, certain minimal charges are applicable:

- Annual Card Fee: PKR 25,000 + Federal Excise Duty (FED), deducted from the loan limit.

- Other Charges: Includes fees for life insurance, card issuance, and delivery, covered under the scheme.

- Late Payment Charges: Applied as per the bank’s policy.

Security and Verification Measures

To ensure answerability and proper use of the loan, the program joins the following measures:

- Personal Guarantee: Borrowers are required to deliver a digital personal assurance.

- Life Assurance: The loan portfolio includes life pledge coverage.

- Business Verification: The Urban Unit will verify business buildings within six months of loan approval and conduct yearly inspections.

Support for Applicants

The program offers multiple resources to assist applicants and ensure their success:

- Feasibility Studies: Templates and guides are available on the Punjab Small Businesses Corporation (PSIC) and Bank of Punjab websites.

- Helpline: Call 1786 for instant support and inquiries.

- Official Website: Visit akf.punjab.gov.pk for the latest updates and claim details.

Frequently Asked Questions (FAQs)

Can I apply if my business is not yet operational?

Yes, the scheme is open to both existing and prospective businesses situated in Punjab.

Is there any penalty for late repayments?

Yes, late expenses are subject to charges as per the bank’s policy.

Can I withdraw the entire loan amount in cash?

No, cash withdrawals are limited to 25% of the loan limit for business drives only.

What happens if I don’t register with PRA or FBR within six months?

Failure to register with PRA or FBR within the stipulated time may lead to restrictions on loan access.

Is there any guarantee required for the loan?

Yes, mortgagors must provide a digital personal guarantee as part of the request process.