Karobar Card Loan

Applying for a loan can be a dangerous step in starting or expanding your business, but it requires careful preparation and understanding of the process. Many candidates make mistakes that can lead to their applications being rejected or cause financial issues down the road. Whether you’re applying for a loan under schemes like the Karobar Card Loan Scheme or any other financial help program, avoiding common mistakes is crucial for success.

This article highlights the most recurrent mistakes made by applicants, providing you with the information needed to avoid them and ensure a smooth loan application process.

Quick Information Table

| Mistake | Impact | Solution |

| Not Providing Complete Documentation | Request rejection or delay | Ensure all required documents are submitted |

| Ignoring Eligibility Criteria | Waste of time and effort | Review the eligibility requirements first |

| Failing to Prepare a Business Plan | Lower chances of approval | Draft a clear and detailed business plan |

| Misunderstanding Loan Terms | Financial difficulties later | Read and understand all terms and conditions |

| Applying for Unnecessary Loan Amount | Unnecessary monetary burden | Calculate the exact loan amount you need |

| Overlooking Timely Repayments | Penalties, damaged credit score | Set reminders and plan payments carefully |

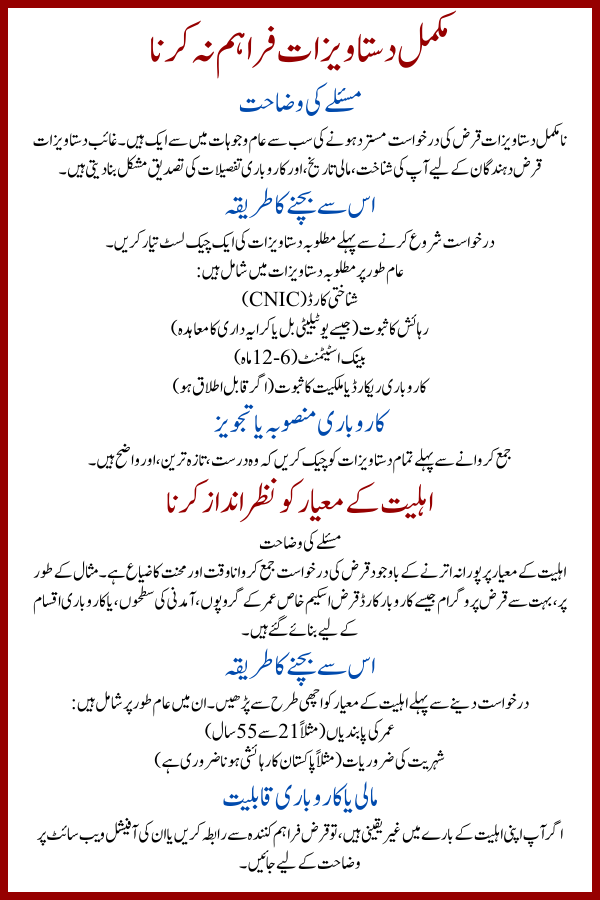

Not Providing Complete Documentation

Why It’s a Problem

Incomplete certification is one of the most common reasons for loan application rejections. Missing documents make it difficult for lenders to verify your identity, fiscal history, and business details.

How to Avoid It

- Prepare a checklist of required forms before starting your application.

- Commonly required documents include:

- CNIC

- Proof of residence (e.g., utility bill or rental agreement)

- Bank statements (6–12 months)

- Business record-keeping or proof of ownership (if applicable)

- Business plan or proposal

- Double-check that all forms are valid, updated, and legible before submission.

Ignoring Eligibility Criteria

Why It’s a Problem

Submitting a loan application without meeting the eligibility criteria wastes time and effort. For instance, many loan programs like the Karobar Card Loan Scheme are calculated for specific age groups, income levels, or business types.

How to Avoid It

- Thoroughly review the eligibility criteria before applying. These often include:

- Age restrictions (e.g., 21–55 years old)

- Internship requirements (e.g., must be a resident of Pakistan)

- Fiscal or business qualifications

- If you’re uncertain about your eligibility, contact the loan provider or visit their official website for clarification.

Click Here:https://akc.punjab.gov.pk/

Failing to Prepare a Solid Business Plan

Why It’s a Problem

A poorly prepared or absent business plan demonstrates a lack of training and seriousness. Lenders are less likely to approve loans for candidates who cannot clearly outline how they will use the funds.

How to Avoid It

- Create a clear and detailed business plan that includes:

- Your business goals and objectives

- A detailed budget explaining how the loan will be used

- Market research and target audience info

- Financial projections, including expected profits

- Use online templates or seek professional help if needed to confirm your plan is specialized and conclusive.

Misunderstanding the Loan Terms

Why It’s a Problem

Not fully sympathetic the loan terms, such as repayment schedules, grace periods, or disadvantages, can lead to fiscal difficulties later.

How to Avoid It

- Carefully read the loan terms and conditions, focusing on:

- Repayment schedules

- Interest rates or hidden charges

- Penalties for late payments

- Grace periods

- Ask questions if anything is unclear and seek explanation from the loan provider.

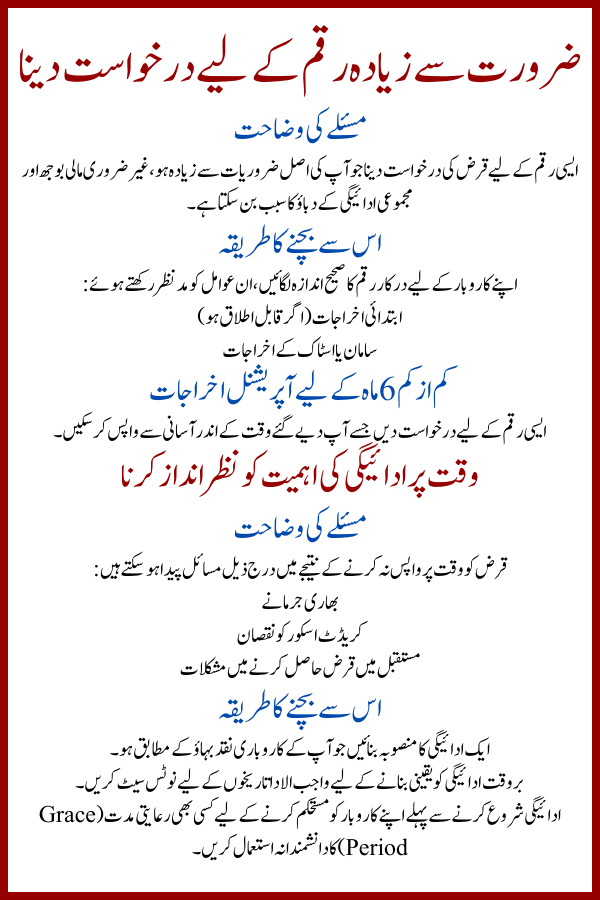

Applying for an Amount Beyond Your Need

Why It’s a Problem

Requesting a loan amount that exceeds your actual needs can create an unnecessary fiscal burden, and collective repayment pressure.

How to Avoid It

- Calculate the exact amount you need for your business by considering:

- Startup costs (if applicable)

- Equipment or inventory expenses

- Operational costs for at least 6 months

- Apply for a representative amount you can contentedly repay within the given timeframe.

Overlooking the Importance of Timely Repayments

Why It’s a Problem

Failing to repay your loan on time can result in:

- Heavy penalties

- A damaged credit score

- Difficulty locking loans in the future

How to Avoid It

- Create a repayment plan that aligns with your business cash flow.

- Set notices for due dates to ensure timely payments.

- Use any grace periods wisely to alleviate your business before starting payments.

Conclusion

The Karobar Card Loan application process can be forthright if you avoid common mistakes and prepare thoroughly. By providing complete documentation, meeting eligibility criteria, and presenting a strong business plan, you increase your chances of approval. Empathetic loan terms, applying for a reasonable amount, and preparation for timely repayments are essential steps for monetary success.

Whether you’re applying for the Karobar Card Loan Scheme or any other program, following these tips will help you secure money and build a strong foundation for your business.

FAQs

1. What is the most common reason for loan application rejection?

Incomplete certification is one of the important causes of loan rejections.

2. Why is a business plan important for a loan application?

A well-prepared business plan proves your vision, goals, and financial understanding, increasing your chances of loan approval.

3. How can I calculate the right loan amount for my business?

Assess your business needs by scheming startup costs, operational expenses, and future fiscal requirements.

4. What happens if I fail to repay my loan on time?

Late repayments may result in penalties, a damaged credit score, and potential difficulties in securing loans in the future.

5. Can I apply for a loan if I don’t meet all eligibility criteria?

It’s optional to examine the eligibility criteria and confirm you meet them before applying to avoid rejection.

6. How can I ensure timely repayments?

Create a repayment plan, set notices, and use any grace periods to steady your finances before starting repayments.

By following these tips and avoiding common pitfalls, you can secure the subsidy you need to grow your business and achieve long-term success.