CM Punjab Asaan Karobar Finance Loan Scheme

The Maryam Nawaz Loan Scheme, formally known as the Asaan Karobar Finance Scheme, is a revolutionary creativity launched by the Punjab government under the leadership of Chief Minister Maryam Nawaz. This system aims to bolster economic growth by providing interest-free loans to small and medium-sized enterprises (SMEs) across the province. By allowing easy access to capital, the program seeks to empower magnates, stimulate job creation, and enhance the overall business environment in Punjab.

Quick Information Table

| Program Name | Asaan Karobar Finance Scheme |

| Start Date | January 2025 |

| End Date | Ongoing |

| Loan Amount | Rs. 1 million to Rs. 30 million |

| Interest Rate | 0% (Interest-Free) |

| Repayment Period | Up to 5 years |

| Application Method | punjab.gov.pk |

| Processing Fee | Rs. 5,000 (Tier 1), Rs. 10,000 (Tier 2) |

Features of the CM Punjab Asaan Karobar Finance Loan Scheme

The Asaan Karobar Finance Scheme offers numerous notable features designed to support and inspire entrepreneurship in Punjab:

- Interest-Free Loans: Eligible businesses can obtain loans ranging from Rs. 1 million to Rs. 30 million without any interest charges.

- Flexible Loan Tiers:

- Tier 1: Loans between Rs. 1 million and Rs. 5 million with a dispensation fee of Rs. 5,000.

- Tier 2: Loans between Rs. 6 million and Rs. 30 million with a dispensation fee of Rs. 10,000.

- Grace Period: Startups have a grace period of up to six months while existing businesses obtain up to three months before repayment begins.

- No Immediate NOCs or Licenses Required: Applicants are not required to obtain immediate No Objection Certificates (NOCs), licenses, or accepted plans to qualify for the loan, advancing the procedure of starting or increasing a business.

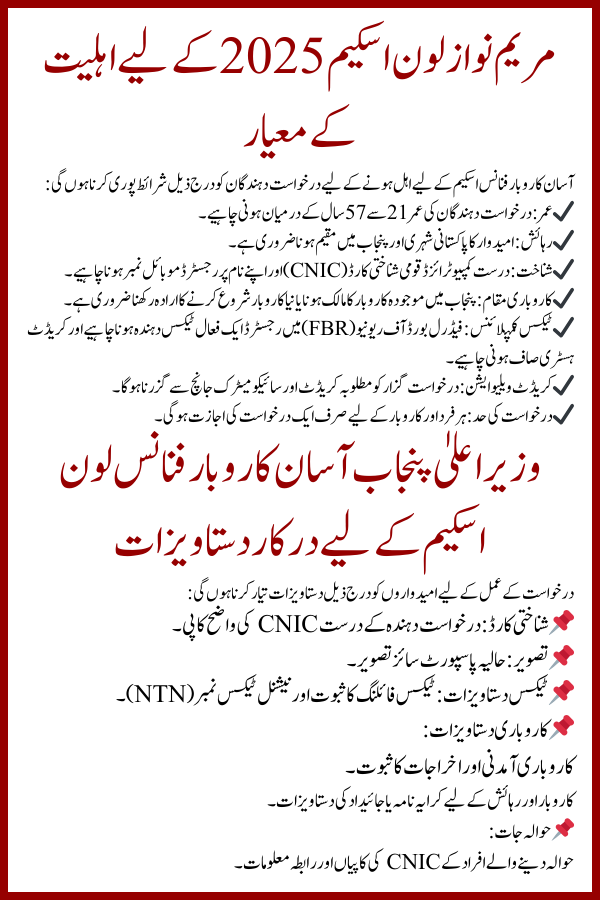

Eligibility Criteria for Maryam Nawaz Loan Scheme 2025

To succeed for the Asaan Karobar Finance Scheme, candidates must meet the following criteria:

- Age: Between 21 and 57 years old.

- Residency: Must be a Pakistani national exist in Punjab.

- Identification: Possess a valid Computerized National Identity Card (CNIC) and a mobile number recorded in the applicant’s name.

- Business Location: Own or plan to inaugurate a business within Punjab.

- Tax Compliance: Be an active taxpayer registered with the Federal Board of Revenue (FBR) and have a clean credit history.

- Credit Valuation: Undergo satisfactory credit and psychometric evaluations.

- Application Limit: Only one application per individual and business is allowed.

Documents Required for CM Punjab Asaan Karobar Finance Loan Scheme

Candidates need to prepare the following documents for the application process:

- CNIC: A clear copy of the applicant’s valid CNIC.

- Photograph: A recent passport-sized photograph.

- Tax Documents: Proof of tax filing and National Tax Number (NTN).

- Business Documentation:

- Proof of business income and expenditures.

- Rent agreement or property documents for both business and house.

- References: CNIC copies and contact information of references.

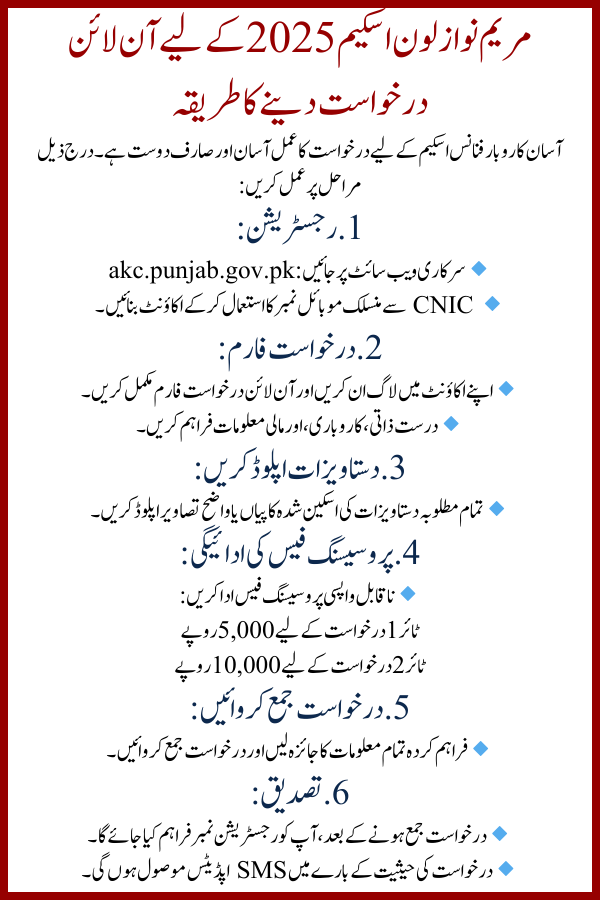

How to Apply Online for Maryam Nawaz Loan Scheme 2025

The application procedure for the Asaan Karobar Finance Scheme is efficient and user-friendly:

- Registration:

- Visit the official website: akc.punjab.gov.pk.

- Create an account using your CNIC-linked mobile number.

- Application Form:

- Log in to your account and fill out the online application form.

- Provide accurate personal, business, and monetary information.

- Document Upload:

- Upload scanned copies or clear images of all required documents.

- Processing Fee:

- Pay the non-refundable processing fee:

- Rs. 5,000 for Tier 1 applications.

- Rs. 10,000 for Tier 2 applications.

- Pay the non-refundable processing fee:

- Submission:

- Review all entered material and apply.

- Confirmation:

- Upon submission, you will receive a registration number and SMS updates regarding your application’s status.

How to Utilize the Loan Funds

The funds got through the CM Punjab Asaan Karobar Finance Loan Scheme can be utilized for various business-related purposes:

- Vendor Payments: Settling dues with suppliers and facility providers.

- Utility Bills: Covering expenses such as electricity, water, and gas bills.

- Government Fees: Paying taxes, licensing fees, and other governmental charges.

- Cash Withdrawals: Up to 25% of the loan amount can be withdrawn in cash for business-related expenses.

Conclusion

The Maryam Nawaz Loan Scheme, or Asaan Karobar Finance Scheme, signifies a significant chance for entrepreneurs and small business owners in Punjab to access considerable, interest-free financial support. By shortening the application process and removing traditional barriers such as instant certifying requirements, the scheme encourages the establishment and growth of SMEs, thereby contributing to