Asaan Karobar Scheme

The Punjab government released the Asaan Karobar Card Scheme and Asaan Karobar Finance Scheme, a ground-breaking scheme aimed to allow tycoons and spur economic growth. This initiative provides medium-sized companies (SMEs) in the province with interest-free loans between PKR 1 million and PKR 30 million. The program seeks to promote free business and sustainable business growth by providing simple access to financial resources.

Quick Information Table

| Program Name | Asaan Karobar Scheme |

| Start Date | Announced (Ongoing) |

| End Date | Not specified |

| Loan Amount | PKR 1 million to 30 million |

| Interest Rate | 0% |

| Application Method | Online via official portal |

| Application Fee | PKR 5,000 for Tier 1, PKR 10,000 for Tier 2 |

Tiers and Details

The Asaan Karobar Scheme is divided into two tiers, catering to different monetary needs:

Tier 1

- Loan Amount: PKR 1 million to 5 million

- Security: Personal guarantee

- Repayment Period: Up to 5 years

- Application Fee: PKR 5,000

Tier 2

- Loan Amount: PKR 6 million to 30 million

- Security: Property or asset-based

- Repayment Period: Up to 5 years

- Application Fee: PKR 10,000

Key Features

Interest Rate

- 0% for all loans under the scheme, ensuring affordability for SMEs.

Grace Period

- New businesses: Up to 6 months

- Existing businesses: Up to 3 months

Equity Contribution

- Tier 1: No equity input required, except for leased vehicles (25%).

- Tier 2: 20% equity contribution required.

- Special Discounts: Women, transgender individuals, and differently-abled persons require only 10% equity influence.

Late Fees

- PKR 1 per PKR 1,000 overdue per day.

Additional Costs

- New or eco-friendly businesses: No yearly fees.

- Existing businesses in Tier 2: 3% annual fee applies.

- Legal, insurance, and registration costs: Additional custodies may apply.

Eligibility Criteria for the Asaan Karobar Scheme

To apply for the Asaan Karobar Finance Scheme, you must meet the following foods:

- Age: Between 25 to 55 years.

- Valid Documents:

- Computerized National Identity Card (CNIC).

- National Tax Number (NTN).

- Tax Compliance: Be a regular taxpayer with no history of bad credit.

- Business Location:

- Own or rent business premises in Punjab.

- Ensure both housing and business reports are within Punjab.

Application Process for the Asaan Karobar Scheme

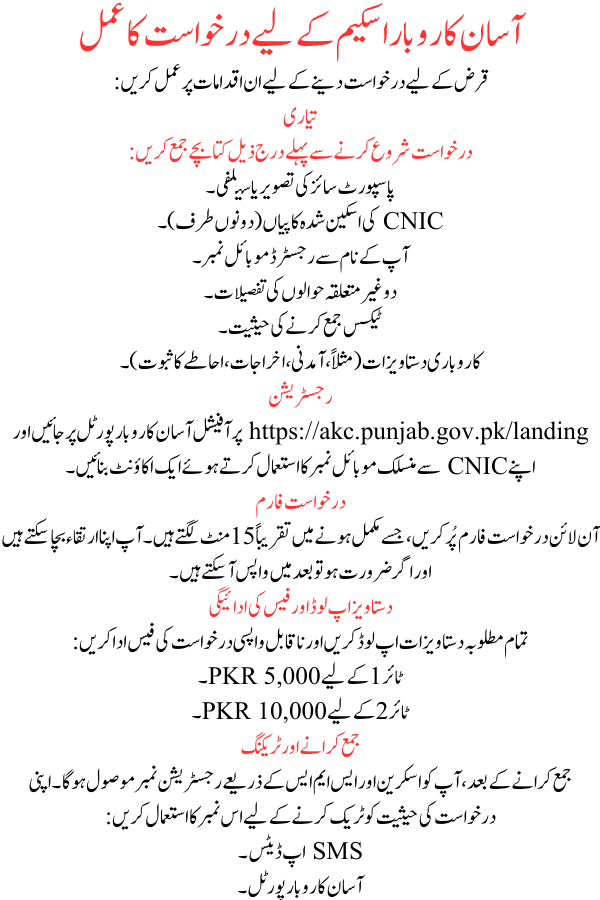

Follow these steps to apply for the loan:

-

Preparation

Gather the following leaflets before starting the request:

- Passport-size photograph or selfie.

- Scanned copies of CNIC (both sides).

- Mobile number registered under your name.

- Details of two non-relative references.

- Tax filing status.

- Business documents (e.g., income, expenses, proof of premises).

-

Registration

Visit the official Asaan Karobar portal at https://akc.punjab.gov.pk/landing and create an account using your CNIC-linked mobile number.

-

Application Form

Fill out the online application form, which takes roughly 15 minutes to complete. You can save your evolution and return later if needed.

-

Document Upload and Fee Payment

Upload all required documents and pay the non-refundable request fee:

- PKR 5,000 for Tier 1.

- PKR 10,000 for Tier 2.

-

Submission and Tracking

After submission, you will receive a registration number via screen and SMS. Use this number to track your request status through:

- SMS updates.

- The Asaan Karobar portal.

Conclusion

The Punjab government’s innovative Asaan Karobar Finance Scheme was created to give SMEs full support and interest-free loans. The initiative promotes entrepreneurship, increases economic activity, and creates jobs in Punjab by making significant financial resources readily available. Entrepreneurs are prepared to take advantage of this chance to launch or grow their businesses, which will contribute to a brighter financial future for the province.

FAQs

What is the application submission deadline for the Asaan Karobar Finance Scheme?

The Punjab government has not proclaimed a specific deadline. It is sensible to apply prompt to benefit from the scheme.

How long does the application process take?

The online application form takes roughly 15 minutes to complete.

Can I save my application and continue later?

Yes, the portal allows you to save your progress and return to complete the application at your suitability.

How can I check the status of my application?

You will receive updates via SMS. Furthermore, you can log in to the Asaan Karobar portal to track your bid status.