Eligible for the Asan Karobar Scheme

The Asaan Karobar Scheme, launched by the Moral Chief Minister of Punjab, Maryam Nawaz Sharif, is a praiseworthy initiative aimed at authorizing small and medium-sized initiatives (SMEs) in the area. This program offers interest-free loans to entrepreneurs, facilitating business establishment, expansion, and innovation. By nurturing free enterprise, the scheme seeks to stimulate monetary growth and cause hire chances across Punjab.

More Read:Maryam Nawaz Karobar Card Loan Scheme

Quick Information Table

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

| Asaan Karobar Scheme | 2025 | Ongoing | PKR 100,000 to 30 million | Online |

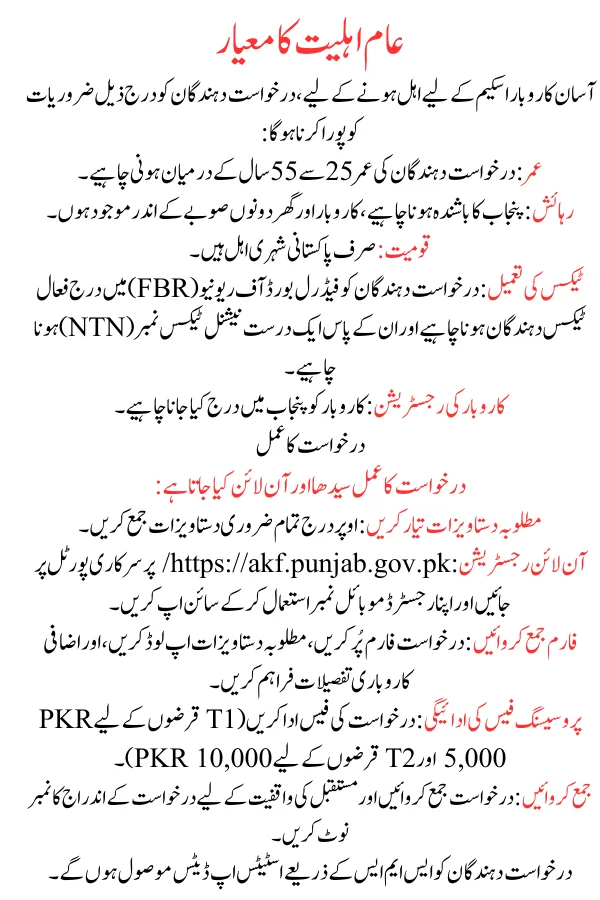

General Eligibility Criteria

Eligible for the Asaan Karobar Scheme, applicants must meet the following requirements:

- Age: Applicants should be between 25 and 55 years old.

- Residency: Must be inhabitants of Punjab, with both the business and house located within the province.

- Nationality: Only Pakistani citizens are eligible.

- Tax Compliance: Applicants must be active taxpayers listed with the Federal Board of Revenue (FBR) and possess a valid National Tax Number (NTN).

- Business Registration: The business should be listed in Punjab.

Specific Groups Targeted by the Scheme

Eligible for the Asaan Karobar Scheme is designed to support various sections of society:

- Youth Entrepreneurs: Encourages young persons to establish their own businesses by if monetary help and mentorship.

- Women Entrepreneurs: Empowers women to venture into free enterprise with additional support, promoting gender equality in the business sector.

- Underprivileged and Marginalized Communities: Offers opportunities to economically disadvantaged persons to improve their living morals through business ownership.

Eligible Business Types

The Eligible for the Asaan Karobar scheme supports a wide range of small and medium-sized creativities, including:

- Retail Businesses: Grocery shops, clothing stores, etc.

- Agricultural Ventures: Farming, dairy, food making, etc.

- Service-Based Businesses: Consulting, beauty facilities, repair facilities, etc.

- Manufacturing Businesses: Small-scale making units.

More Read:Maryam Nawaz Loan Scheme 2025

Loan Amount and Terms

The Eligible for the Asaan Karobar scheme offers two tiers of interest-free loans:

- Tier 1 (T1): Loans ranging from PKR 1 million to PKR 5 million, secured with a personal guarantee, repayable over up to 5 years.

- Tier 2 (T2): Loans ranging from PKR 6 million to PKR 30 million, needful security, also repayable over up to 5 years.

A grace period of up to 6 months is if for startups, and up to 3 months for current businesses. Payments are made in equal monthly installments. Dispensation fees are PKR 5,000 for T1 loans and PKR 10,000 for T2 loans.

Key Documentation Required

Applicants need to prepare the following documents:

- National Identity Card (CNIC): Valid CNIC of the applicant.

- Proof of Residence: Utility bills, rent agreement, or domicile verifying Punjab placement.

- Business Registration Documents: Certificate or proof of registered business in Punjab.

- Business Plan: Detailed plan amplification loan operation and business goals.

- Bank Statements: Past 6 months’ bank transaction history.

- Income Proof: Documentation of existing income or revenue streams.

- Application for Loan: Completed and signed request form.

- Photographs: Recent passport-size photographs of the applicant.

- Guarantee Documents: Guarantor’s CNIC and financial details (if required).

- Tax Documents: NTN or proof of tax filing, if applicable.

More Read:CM Punjab Maryam Nawaz Sharif’s Initiative Agriculture

Application Process

The application process is straightforward and conducted online:

- Prepare Required Documents: Gather all necessary documents as listed above.

- Online Registration: Visit the official portal at https://akf.punjab.gov.pk/ and sign up using your registered mobile number.

- Form Submission: Fill out the application form, upload the required documents, and provide extra business details.

- Processing Fee Payment: Pay the application fee (PKR 5,000 for T1 loans and PKR 10,000 for T2 loans).

- Submission: Submit the application and note the application registering number for future orientation.

Applicants will receive status updates via SMS.

Conclusion

The Eligible for the Asaan Karobar Scheme is a important opportunity for wishful and current businesspersons in Punjab. By if interest-free loans and complete support, the scheme aims to foster a thriving business setting, promote economic development, and uplift various sections of society. Potential applicants are encouraged to review the eligibility criteria, prepare the necessary certification, and apply through the official online portal to take gain of this creativity.