Asaan Karobar Loan Scheme

The Asaan Karobar Loan Scheme is a revolutionary initiative launched by the Punjab government to authorize small and medium-sized enterprises (SMEs) by providing interest-free loans. This program’s goal to stimulate monetary growth and support impresarios across the province.

Quick Information Table

| Detail | Information |

|---|---|

| Start Date | Applications are currently open. |

| Required Documents | – Completed application form – Copy of CNIC – Business plan/proposal – Proof of business registration (if applicable) – Bank statements or financial documents (if applicable) |

| Eligibility | – Residents of Punjab – Aged between 21 to 45 years – New or existing entrepreneurs with viable business ideas – Must meet the creditworthiness criteria set by the program |

| Official Website | Asaan Karobar Finance |

| Last Date to Apply | No specific deadline is mentioned; applicants are advised to apply promptly as funds may be limited. |

What is the Asaan Karobar Scheme?

The Asaan Karobar Scheme includes two main components:

- Asaan Karobar Finance Scheme: This constituent offers interest-free loans ranging from Rs. 1 million to Rs. 30 million to SMEs. The loans are paid through the Bank of Punjab and are repayable in easy monthly payments over up to five years.

- Asaan Karobar Card: Designed for startups and small businesses, this card delivers interest-free loans of up to Rs. 1 million. The card eases payments for raw materials, government fees, taxes, and utility bills, with the option to withdraw up to 25% of the loan quantity in cash. Repayment is structured over three years in wieldy installments.

Key Features of the Scheme

- Interest-Free Loans: Both system components offer loans without any interest, reducing the economic load on tycoons.

- Flexible Loan Amounts: Loans range from Rs. 1 million to Rs. 30 million, catering to various business needs.

- Easy Repayment Plans: Repayment periods cover up to five years, with installments designed to be inexpensive.

- Minimal Initial Requirements: Applicants are not required to obtain immediate No Objection Certificates (NOCs), licenses, or accepted plans, allowing them to begin business operations promptly.

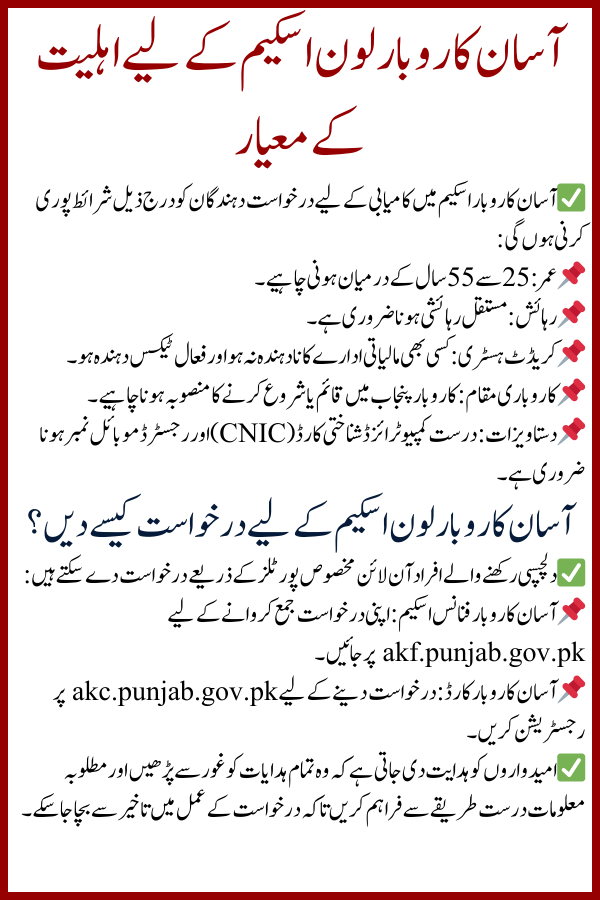

Eligibility Criteria for Asaan Karobar Loan Scheme

To succeed for the Asaan Karobar Scheme, applicants must meet the following circumstances:

- Age: Between 25 and 55 years old.

- Residency: Permanent resident of Punjab.

- Credit History: Must not be a defaulter of any monetary organization and should be an active taxpayer.

- Business Location: The business should be working within Punjab or planned to be established in the province.

- Documentation: Valid Computerized National Identity Card (CNIC) and a listed mobile number.

How to Apply for the Asaan Karobar Loan Scheme

Interested persons can apply online through the devoted portals:

- Asaan Karobar Finance Scheme: Visit akf.punjab.gov.pk to submit your application.

- Asaan Karobar Card: Apply at akc.punjab.gov.pk.

Candidates are advised to carefully read the orders and ensure all required information is precisely provided to avoid delays in dispensation.

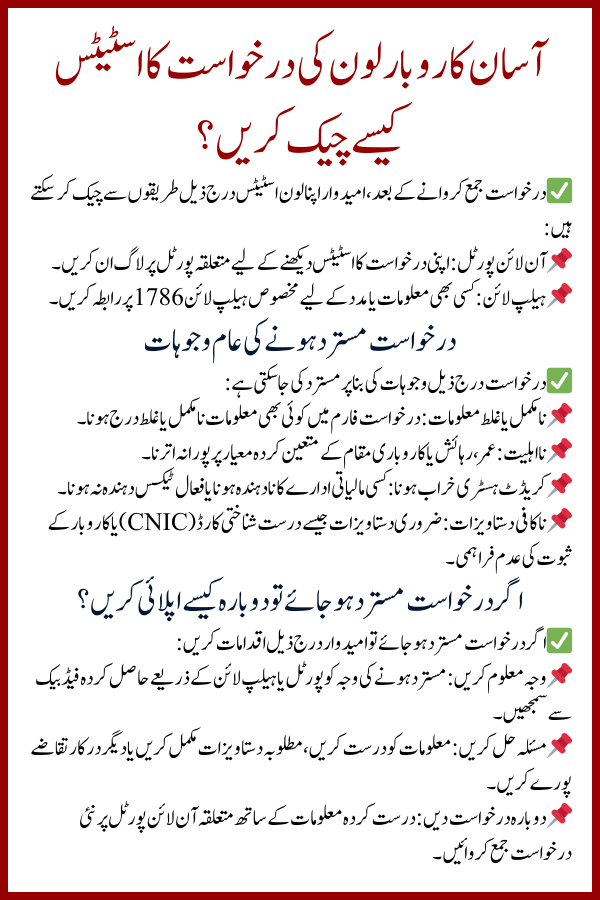

How to Check Asaan Karobar’s Loan Application Status

After applying, candidates can check their loan status by:

- Online Portal: Log in to the individual application portal using your identifications to view the status.

- Helpline: Contact the dedicated helpline at 1786 for assistance and investigations.

Common Reasons for Application Rejection

Requests may be rejected due to:

- Incomplete or Incorrect Information: Missing or imprecise details in the application form.

- Ineligibility: Not meeting the quantified age, residency, or business location criteria.

- Poor Credit History: Being a defaulter with any financial institution or not being an active taxpayer.

- Insufficient Documentation: Failure to deliver necessary documents such as a valid CNIC or proof of business.

How to Reapply if Rejected

If an application is rejected, candidates should:

- Identify the Reason: Understand the cause of rejection by studying feedback provided through the portal or helpline.

- Address the Issue: Correct the identified problems, such as updating information or obtaining required documents.

- Reapply: Submit a new request with corrected information through the suitable online portal.

Loan Repayment Terms and Conditions

- Repayment Period: Up to five years for the Money Scheme and three years for the Card.

- Installments: Equal monthly installments as per the agreed schedule.

- Late Payment Charges: A nominal fee of Rs. 1 per Rs. 1,000 per day is appropriate for overdue payments.

FAQs

Q1: Can individuals outside Punjab apply for the Asaan Karobar Loan Scheme ?

No, only permanent inhabitants of Punjab are eligible for this arrangement.

Q2: Is collateral required for these loans?

The scheme offers interest-free loans without the need for collateral; however, specific terms may vary, and it’s sensible to consult the official guidelines.

Q3: Are there any fees associated with the application process?

The request process is free of charge.

Q4: Can existing businesses apply for the Asaan Karobar Card?

Yes, both new and current businesses within Punjab can apply for the Asaan Karobar Card.