Maryam Nawaz Karobar Card loan Scheme

The Maryam Nawaz Karobar Card Loan Scheme is a flagship initiative by the Punjab Government to develop free enterprise and secondary small and medium creativities (SMEs). With the overview of the Karobar Card, hopeful and existing business owners can access interest-free loans and other benefits to kickstart or expand their ventures. This program is part of the government’s vision to empower persons financially and donate to economic growth across Pakistan.

This article covers all aspects of the Karobar Card Loan Scheme, including its features, objectives, registration process, loan categories, and benefits.

Quick Information Table

| Program Name | Maryam Nawaz Karobar Card Loan Scheme |

| Start Date | January 2025 |

| End Date | Ongoing |

| Loan Amount | Rs. 50,000 to Rs. 5 million |

| Interest Rate | Interest-Free |

| Eligibility | Punjab residents aged 21–55, including men, women, and youth |

| Application Method | Online and Offline |

Features of the Karobar Card Loan Scheme

The Karobar Card Loan Scheme is intended with several key features to ensure suitability and fiscal inclusion for hopeful businesspersons:

- Interest-Free Loans

- Loans under the scheme are provided at 0% interest, meaningfully reducing the fiscal burden on borrowers.

- Flexible Loan Amounts

- Applicants can apply for loans ranging from Rs. 50,000 to Rs. 5 million, depending on their business needs.

- Digital Integration

- The Karobar Card is linked to a digital platform, enabling recipients to manage their funds online and make cashless dealings.

- Inclusive Approach

- The program is open to men, women, youth, and differently-abled individuals, endorsing equality.

- Simplified Application Process

- Both online and offline registration options are available, confirming ease of access for persons from urban and rural areas.

Click Here:https://akc.punjab.gov.pk/

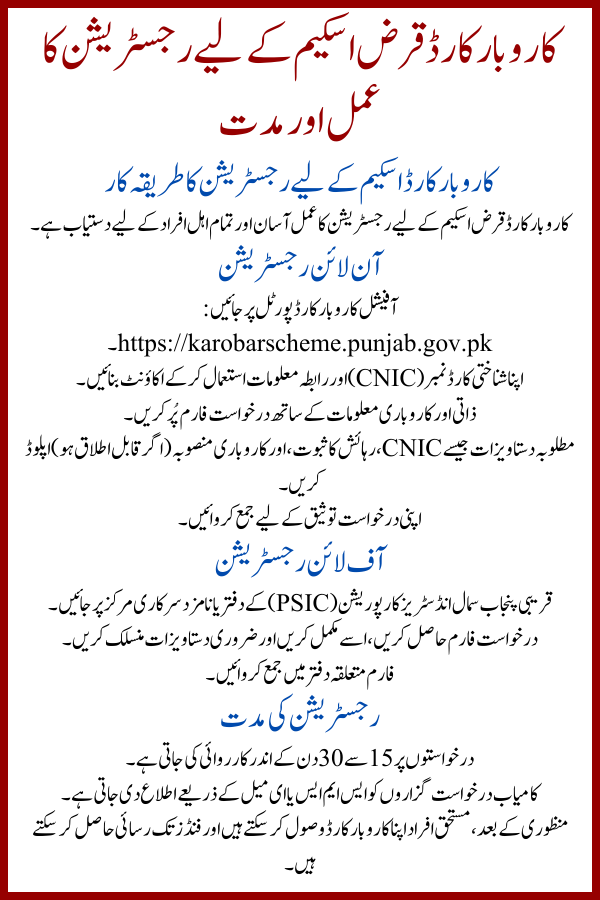

Karobar Card loan Scheme Registration Process and Timeline

How to Register for the Karobar Card Scheme

The registration process for the Karobar Card Loan Scheme is candid and available to all eligible individuals.

- Online Registration

- Visit the official Karobar Card portal (https://karobarscheme.punjab.gov.pk).

- Create an account using your CNIC and contact information.

- Fill out the application form with personal and business information.

- Upload required forms such as CNIC, proof of residence, and business plan (if applicable).

- Submit your application for verification.

- Offline Registration

- Visit the nearest Punjab Small Industries Corporation (PSIC) office or a nominated government center.

- Collect the application form, fill it out, and attach essential documents.

- Submit the form to the individual office for dispensation.

Registration Timeline

- Applications are treated within 15–30 days, and successful applicants are notified via SMS or email.

- Once approved, recipients can collect their Karobar Card and access funds.

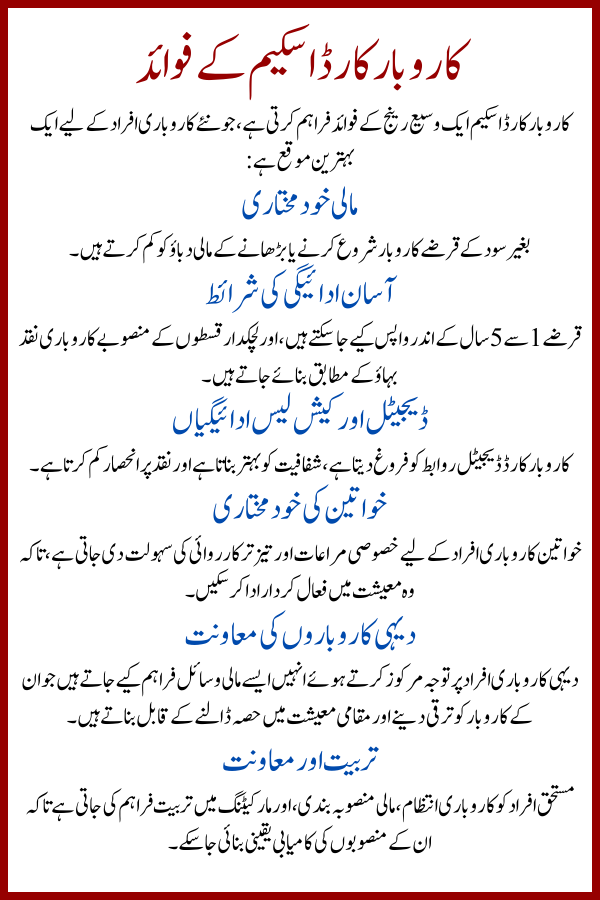

Benefits of the Karobar Card Scheme

The Karobar Card Scheme provides a wide range of benefits, making it an excellent chance for aspiring impresarios:

- Financial Empowerment

- Interest-free loans reduce the financial stress of starting or increasing a business.

- Easy Repayment Terms

- Loans can be repaid over 1 to 5 years, with flexible installment plans to suit business cash flows.

- Digital and Cashless Payments

- The Karobar Card facilitates digital connections, improving transparency and dropping dependency on cash.

- Women Empowerment

- Special motivations and fast-track dispensation for women impresarios encourage their active contribution in the economy.

- Support for Rural Businesses

- Focuses on rural magnates, providing them with the financial tools to grow their businesses and contribute to local economies.

- Training and Support

- Recipients receive training in business management, financial planning, and marketing to ensure the success of their ventures.

Conclusion

The Maryam Nawaz Karobar Card Loan Scheme is a game-changer for entrepreneurs in Pakistan, offering financial support, complex processes, and inclusivity. With its focus on authorizing SMEs, reducing unemployment, and promoting fiscal independence, the program has the potential to transform the economic landscape of Punjab and beyond.

If you are an aspiring magnate or a business owner, don’t miss this chance. Register today and take the first step toward financial independence and business success. The Maryam Nawaz Karobar Card loan Scheme is not just a loan program; it’s a pathway to a brighter and more well-off future.

Frequently Asked Questions (FAQs)

1. What is the Maryam Nawaz Karobar Card Loan Scheme?

The scheme provides interest-free loans to entrepreneurs and SMEs in Punjab to support business growth and monetary inclusion.

2. Who is eligible for the scheme?

Inhabitants of Punjab aged 21 to 55, including men, women, youth, and differently-abled individuals, can apply.

3. How much loan can I get under the Karobar Card Scheme?

Loan amounts range from Rs. 50,000 to Rs. 5 million, depending on business needs and eligibility.

4. How can I apply for the Karobar Card?

You can apply online via the Karobar Card portal or offline at a Punjab Small Industries Corporation (PSIC) office.

5. Are the loans under this scheme interest-free?

Yes, all loans under the scheme are provided at 0% interest.