Maryam Nawaz Asaan Karobar Card Loan Scheme

The Maryam Nawaz Asaan Karobar Card Loan Scheme is an innovative creativity by the Punjab government aimed at supporting impresarios, small businesses, and individuals with a desire to establish or expand their ventures. Offering interest-free loans, flexible repayment options, and basic application processes, the scheme empowers the people of Punjab to take control of their monetary futures and contribute to Pakistan’s economic growth.

The program is particularly focused on fostering chances for women, youth, and marginalized communities, ensuring inclusivity and availability for all eligible applicants.

Click Here:https://akc.punjab.gov.pk/

Quick Information Table

| Program Name | Maryam Nawaz Asaan Karobar Card Loan Scheme |

| Start Date | January 2025 |

| End Date | Ongoing |

| Loan Amount | Rs. 50,000 to Rs. 5 million |

| Interest Rate | Interest-Free |

| Application Method | Online and Offline |

| Grace Period | 3–6 months, depending on the loan tier |

| Eligibility | Residents of Punjab aged 21–55 |

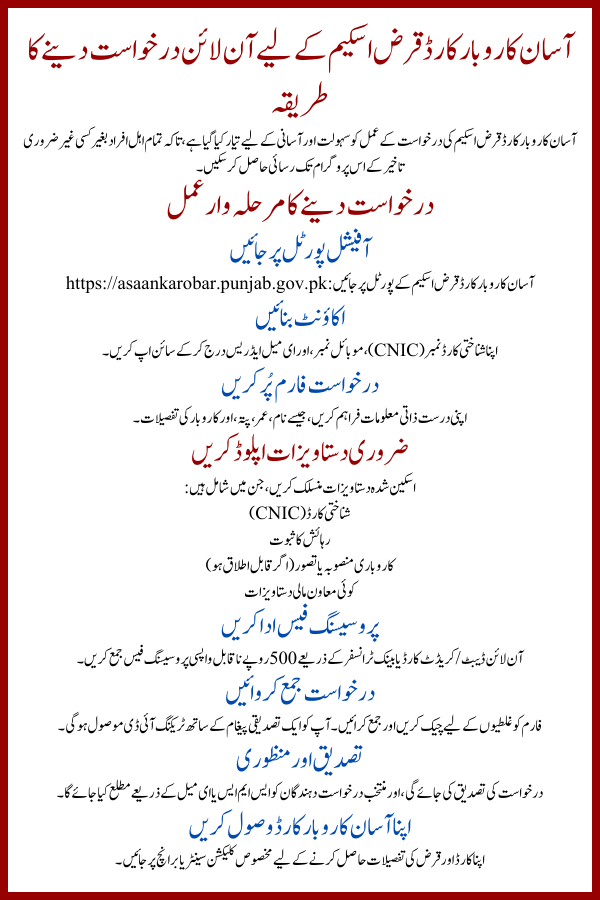

How to Apply Online for the Asaan Karobar Card Loan Scheme

The Asaan Karobar Card Loan Scheme application process has been easy for ease and suitability, ensuring that all eligible persons can access the program without excessive delays.

Step-by-Step Application Process

- Visit the Official Portal

- Go to the Asaan Karobar Card Loan Scheme portal at https://asaankarobar.punjab.gov.pk.

- Create an Account

- Sign up by entering your CNIC, mobile number, and email address.

- Fill Out the Application Form

- Provide precise personal information, such as your name, age, address, and business details.

- Upload Required Documents

- Attach scanned copies of:

- CNIC

- Proof of residency

- Business plan or concept (if applicable)

- Any supporting financial documents

- Pay Processing Fee

- Submit a non-refundable processing fee of Rs. 500 online through debit/credit card or bank transfer.

- Submit Application

- Review the form for errors and submit it. A validation message with a tracking ID will be sent to you.

- Verification and Approval

- The application will be verified, and accepted applicants will be notified via SMS or email.

- Collect Your Asaan Karobar Card

- Visit the designated collection center or branch to receive your card and loan disbursement details.

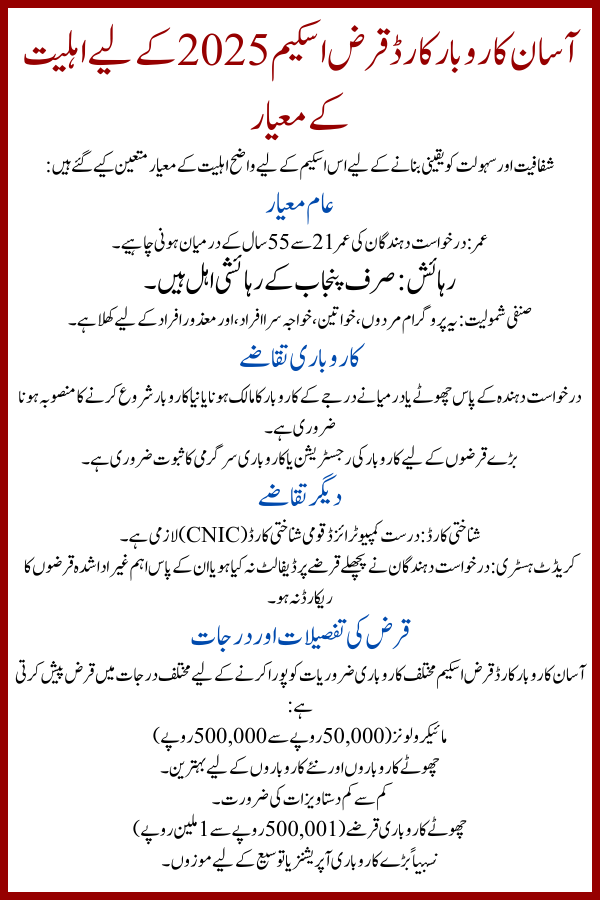

Eligibility Criteria for the Asaan Karobar Card Loan Scheme 2025

To ensure transparency and convenience, the scheme has a clear set of eligibility criteria:

General Criteria

- Age: Applicants must be between 21 and 55 years old.

- Residency: Only inhabitants of Punjab are eligible.

- Gender Inclusivity: The program is open to men, women, transgender individuals, and persons with disabilities.

Business Requirements

- The applicant must either own or plan to inaugurate a small or medium business.

- A valid business registration or proof of business activity is compulsory for larger loans.

Other Requirements

- CNIC: A valid Computerized National Identity Card is mandatory.

- Credit History: Applicants must not have defaulted on previous loans or have an active record of important unpaid debts.

Loan Details and Tiers

The Asaan Karobar Card Loan Scheme offers loans in different tiers to cater to varied business needs:

1. Microloans (Rs. 50,000 to Rs. 500,000)

- Best for small-scale businesses and startups.

- Minimal certification required.

2. Small Business Loans (Rs. 500,001 to Rs. 1 million)

- Suitable for slightly larger processes or expansions.

3. Medium Business Loans (Rs. 1 million to Rs. 5 million)

- Designed for SMEs with important growth plans.

Repayment Terms

- Loan repayment can extend up to 5 years, dependent on the loan amount.

- Monthly installments are kept affordable to ensure sustainability for the borrower.

Benefits of the Asaan Karobar Card Loan Scheme

The Asaan Karobar Card Loan Scheme offers several benefits to entrepreneurs:

- Interest-Free Loans

- Reduces the financial burden on borrowers, allowing them to focus on business growth.

- Inclusivity

- Inspires women, youth, and marginalized societies to participate in the economy.

- Digital Integration

- The Asaan Karobar Card enables cashless transactions, promoting digital financial literacy.

- Flexibility

- Loan repayment terms and grace periods are designed to house business cash flows.

- Business Training

- Recipients receive training in fiscal management and publicity to ensure success.

Latest Updates: What’s New in 2025?

- Increased Loan Limits

- The maximum loan limit has been elevated to Rs. 5 million, accommodating medium-sized enterprises.

- Focus on Women Entrepreneurs

- Special motivations and fast-track approvals are being offered to women.

- Digital Monitoring

- A mobile app has been launched to help borrowers track loan payments and repayment schedules.

- Partnerships with Financial Institutions

- Relationship with banks ensures faster loan dispensation and better financial literacy programs.

FAQs

1. Who can apply for the Maryam Nawaz Asaan Karobar Card Loan Scheme ?

Residents of Punjab aged 21–55, including men, women, and relegated groups, are eligible.

2. How can I apply for the loan?

Requests can be submitted online via the official portal or offline at chosen centers.

3. Are the loans under this scheme interest-free?

Yes, all loans are provided at 0% interest.

4. What is the maximum loan amount available?

You can apply for loans up to Rs. 5 million under this scheme.

5. How long is the repayment period?

The repayment period can extend up to 5 years, depending on the loan amount.

6. What documents are required for the application?

You will need your CNIC, proof of house, business plan (if applicable), and supporting monetary documents.

Last Words

The Maryam Nawaz Asaan Karobar Card Loan Scheme is a revolutionary advantage aimed at transforming the business landscape of Punjab. By offering interest-free loans, simplified processes, and digital integration, the program empowers individuals to realize their business dreams and contribute to Pakistan’s economic development.

If you’re a resident of Punjab with a business idea or a current venture, don’t miss out on this opportunity. Apply for the Maryam Nawaz Asaan Karobar Card Loan Scheme today and take a step toward financial individuality and success!