Karobar Card Loan Scheme

The Karobar Card Loan Program is a revolutionary advantage introduced by the government to support small and medium-sized enterprises (SMEs), budding entrepreneurs, and individuals with advanced business ideas. This platform provides interest-free loans and simplified application procedures, aiming to create economic chances and reduce unemployment. The scheme is designed to inspire financial inclusion, entrepreneurship, and justifiable economic growth across Pakistan.

This article explains the details of the Karobar Card Loan Scheme, counting eligibility criteria, application process, required documents, and the numerous benefits it offers.

Quick Information Table

| Program Name | Karobar Card Loan Scheme |

| Start Date | January 2025 |

| End Date | Ongoing |

| Loan Amount | Rs. 50,000 to Rs. 5 million |

| Interest Rate | Interest-Free |

| Eligibility | Entrepreneurs aged 21–55, residents of Pakistan |

| Application Method | Online and Offline |

Understanding the Karobar Card Loan Scheme

The Karobar Loan Scheme is designed to provide monetary help to individuals and businesses, enabling them to establish or expand their ventures. The program focuses on facilitating entrepreneurship by offering interest-free loans through a efficient and transparent process.

Key Features

- Loan Limits: Loans range from Rs. 50,000 for micro-businesses to Rs. 5 million for medium-scale enterprises.

- Digital Integration: Recipients receive a Karobar Card, which allows for seamless transactions and fund management.

- Inclusive Approach: The program is open to men, women, and differently-abled persons, endorsing equality and monetary authorization.

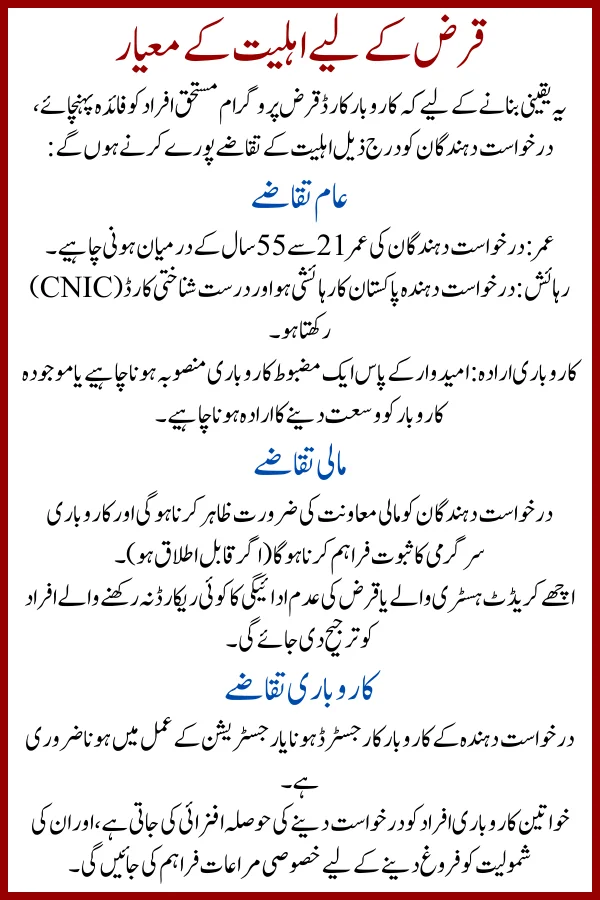

Eligibility Criteria for the Loan

To ensure that the Karobar Card Loan Program benefits justifiable individuals, applicants must meet the following eligibility requirements:

General Requirements

- Age: Applicants must be between 21 and 55 years old.

- Residency: Must be a resident of Pakistan, with a valid CNIC.

- Entrepreneurial Intent: Candidates should have a solid business idea or plan to expand an existing business.

Financial Requirements

- Candidates must demonstrate a need for financial support and provide proof of business activity (if applicable).

- Individuals with a good credit history or no record of loan defaults will be given priority.

Business Requirements

- The applicant’s business must be registered or in the process of being registered.

- Women entrepreneurs are encouraged to apply, with special inducements provided to promote their participation.

Click Here:https://akc.punjab.gov.pk/

Creating a Solid Business Plan

A well-crafted business plan is crucial for safeguarding a loan under the Karobar Card Loan Program. This document demonstrates your business’s potential and outlines how the funds will be utilized.

Key Components of a Business Plan

- Exclusive Summary

- A brief overview of your business idea, goals, and strategies.

- Market Investigation

- Research on your target audience, competitors, and market trends.

- Fiscal Projections

- Detailed income and expense forecasts, along with ROI prospects.

- Application of Loan

- A clear collapse of how the loan amount will be spent.

Document Preparation for Application

Candidates must submit the following documents to confirm a successful application:

Required Documents

- CNIC Copy

- A valid Computerized National Identity Card.

- Proof of Residence

- Utility bill or rental agreement as proof of address.

- Business Plan

- A detailed plan showcasing your business idea and financial requirements.

- Bank Statement

- A 6-month bank statement to prove financial stability (if applicable).

- Additional Documents

- Any certificates or registrations related to your business (if available).

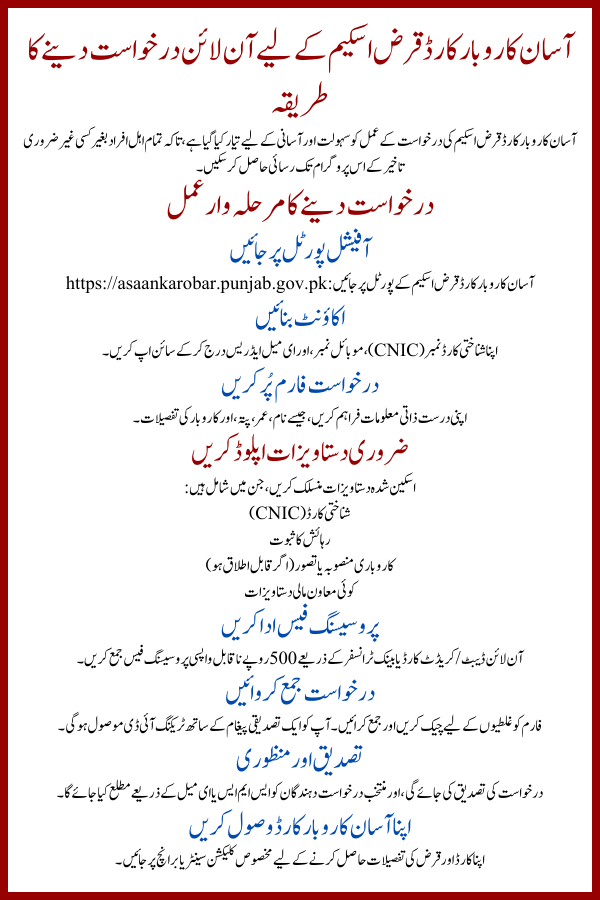

How to Apply Online for the Loan Scheme

The Karobar Card Loan Program has a user-friendly online application system, making it available to all eligible applicants.

Step-by-Step Guide

- Visit the Official Portal

- Go to https://karobarscheme.punjab.gov.pk.

- Create an Account

- Register by entering your CNIC, mobile number, and email address.

- Fill Out the Application Form

- Provide personal information, business information, and loan amount requested.

- Upload Required Documents

- Attach scanned copies of all necessary documents.

- Submit the Form

- Review the request for errors and submit it. A confirmation message will be sent to your registered email or mobile number.

- Verification Process

- Your application will be verified by the concerned section, and you will be notified of the approval status within 15–30 days.

- Receive the Karobar Card

- Approved applicants can collect their Karobar Card, which will grant them access to the funds.

Benefits of the Karobar Card Loan Scheme

The Karobar Loan Scheme offers several benefits to wishful impresarios and business owners:

- Interest-Free Loans

- Elimination of interest reduces the monetary burden, enabling businesses to grow sustainably.

- Inclusive Opportunity

- Encourages women, youth, and differently-abled individuals to contribute in economic activities.

- Digital Convenience

- The Karobar Card facilitates digital payments and fund management, reducing reliance on cash transactions.

- Economic Growth

- By supporting SMEs, the scheme contributes to Pakistan’s overall economic development.

- Job Creation

- Helps businesses expand, creating more job opportunities across numerous sectors.

- Training and Support

- Receivers receive business training and mentorship, ensuring better management of their ventures.

Conclusion

The Karobar Card Loan Scheme is a revolutionary initiative aimed at empowering Pakistan’s financiers and strengthening the economy. By providing interest-free loans and offering a straightforward application process, the scheme ensures financial inclusion and promotes maintainable business growth. Whether you’re starting a new business or growing an existing one, this program provides a unique opportunity to achieve your entrepreneurial goals.

If you meet the eligibility criteria, don’t hesitate to apply and take the first step toward fiscal independence and success.

FAQs

1. Who can apply for the Karobar Card Loan Scheme?

Individuals aged 21–55 residing in Pakistan and preparation to start or expand a business are eligible.

2. What is the maximum loan amount under this scheme?

The maximum loan amount is Rs. 5 million, depending on the applicant’s needs and eligibility.

3. Are the loans interest-free?

Yes, all loans provided under this scheme are interest-free.

4. How can I apply for the Karobar Card Loan Scheme?

Applications can be submitted online via the official portal or offline at chosen centers.

5. What documents are required for the application?

You will need your CNIC, proof of house, business plan, and bank statement, among other documents.

6. Can women apply for the loan?

Yes, the scheme encourages women entrepreneurs, contribution special incentives to promote their participation.

7. What is the repayment period?

Loans can be repaid over a period of 1 to 5 years, depending on the loan amount and terms.

Take advantage of this transformative opportunity and donate to Pakistan’s growing economy by applying for the Karobar Card Loan Scheme today!