Apply for Asaan Karobar Card Online

The Government of Punjab has presented the CM Punjab Asaan Karobar Card to support small businesses by if interest-free loans. This creativity aims to approve magnates and small business owners, nurturing economic growth and job creation. With loans of up to PKR 1 million, this program provides monetary help to SMEs (Small and Medium Enterprises) facing monetary sprints.

This program is designed for maximum proximity, joining digital solutions like mobile apps and Point-of-Sale (POS) systems. These skins enable business owners to access funds easily and manage their operations efficiently. Below, we provide a inclusive guide on the Asaan Karobar Card and how you can apply linked through akc.punjab.gov.pk.

More Read:Important Documents for the Asaan Karobar Card 2025

Quick Information Table

| Feature | Details |

| Program Name | CM Punjab Asaan Karobar Card |

| Start Date | Ongoing |

| End Date | Not specified |

| Loan Amount | Up to PKR 1 million |

| Interest Rate | 0% (Interest-free) |

| Loan Tenure | 3 years |

| Grace Period | 3 months |

| Application Mode | Online via akc.punjab.gov.pk |

Key Features of the Asaan Karobar Card

The Apply for Asaan Karobar Card Online offers numerous benefits to eligible applicants:

- Interest-Free Loans: Tycoons can have up to PKR 1 million without any interest.

- Flexible Repayment Options: The loan tenure is three years, with a three-month grace period.

- Revolving Credit Facility: Debtors can access funds multiple times within the approved limit.

- Digital Loan Management: The system is integrated with mobile apps and POS systems for effectual financial running.

- Government-Backed Initiative: This program safeguards fiscal security and transparency.

Allocation and Vision

Under the leadership of the Punjab Chief Minister, the government has allocated PKR 84 billion for this initiative, with PKR 48 billion reserved specifically for the Asaan Karobar Card Online. This project aims to promote economic inclusivity by cheering free enterprise among youth, startups, and small business owners.

More Read:Akhuwat Foundation Interest-Free Loan 2025 Online Application

How to Apply for the Asaan Karobar Card

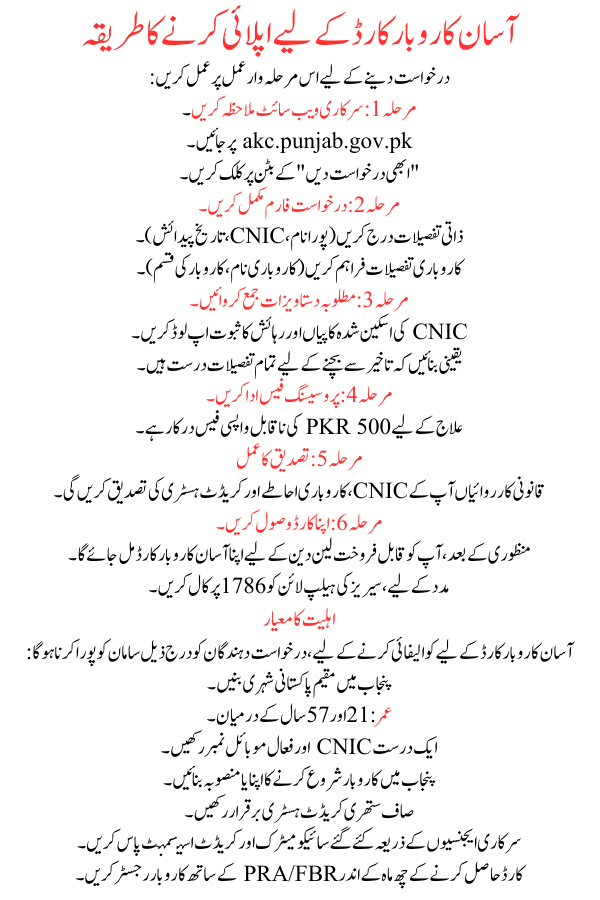

Follow this step-by-step process to apply for Asaan Karobar Card Online:

Step 1: Visit the Official Website

- Go to akc.punjab.gov.pk.

- Click on the “Apply Now” button.

Step 2: Complete the Application Form

- Enter personal details (Full Name, CNIC, Date of Birth).

- Provide business details (Business Name, Type of Business).

Step 3: Submit Required Documents

- Upload scanned copies of CNIC and proof of residence.

- Ensure all details are correct to avoid delays.

Step 4: Pay the Processing Fee

- A non-refundable fee of PKR 500 is required for treating.

Step 5: Verification Process

- Legal actions will verify your CNIC, business premises, and credit history.

Step 6: Receive Your Card

- Upon approval, you will receive your Asaan Karobar Card for saleable dealings.

- For help, call the series’ helpline at 1786.

Eligibility Criteria

To qualify for the Asaan Karobar Card Online, applicants must meet the following supplies:

- Be a Pakistani national residing in Punjab.

- Age: Between 21 and 57 years.

- Possess a valid CNIC and active mobile number.

- Own or plan to start a business in Punjab.

- Maintain a clean credit history.

- Pass psychometric and credit assessments conducted by official agencies.

- Register the business with PRA/FBR within six months of getting the card.

More Read:PITB Asaan Karobar Scheme Registration Now Available Online 2025

Loan Usage and Repayment Details

The Apply for Asaan Karobar Card Online offers a flexible repayment plan:

- First 50% of the Loan: Accessible within six months of approval.

- Grace Period: Borrowers get a three-month grace period before payments begin.

- Monthly Installments: Repayment starts at 5% of the outstanding loan balance per month.

- Second 50% of the Loan: Released upon timely repayment of the first half.

- Equal Monthly Installments (EMIs): The residual balance is repaid over 24 months after the first year.

- Usage Restrictions: Funds must be used for business-related expenses like vendor payments, utility bills, and inventory purchases. Personal dealings are not allowed.

Charges and Fees

This program ensures affordability with trifling fees:

- Annual Card Fee: PKR 25,000 + FED, deducted from the accepted loan limit.

- Additional Charges: Includes life assurance, card issuance, and delivery fees.

- Late Payment Penalty: Applied giving to the bank’s policy.

Empowering Entrepreneurs in Punjab

The CM Punjab Asaan Karobar Card Online is a game-changer for small business owners in the province. By if interest-free loans and a streamlined digital application process, this fancy aims to remove financial barriers and boost free enterprise. With a promise to economic growth and job creation, this set safeguards that small businesses have the financial backing needed to thrive.