Asaan Karobar Card Application Form

The Punjab government developed the novel Asaan Karobar Card to foster entrepreneurs and small business owners. It helps businesses grow without having to worry about repaying interest by providing interest-free loans up to PKR 1 million. This scheme’s entirely digital application process guarantees slide, convenience, and ease. These money can be used by entrepreneurs for vendor expenses, development, or operational expenses.

To help you understand this program, here’s a quick overview:

| Feature | Details |

| Maximum Loan | PKR 1 million |

| Interest Rate | 0% |

| Loan Tenure | Up to 3 years |

| Application Mode | Online via official portal |

Why Apply for the Asaan Karobar Card?

The Asaan Karobar Card offers significant advantages to small business owners:

- Interest-Free Financing: Reduces the cost of copying, allowing businesses to focus on growth.

- Flexibility in Repayment: Borrowers can repay loans in wieldy payments, alleviating financial pressure.

- User-Friendly Application Process: The fully digital platform simplifies the application process.

- Transparency: Funds are allocated in a clear and answerable manner, ensuring proper utilization.

- Business Growth Opportunities: Access to interest-free capital fosters novelty and expansion.

This program is a lifeline for businesspersons, allowing them to attain their commercial goals effectively.

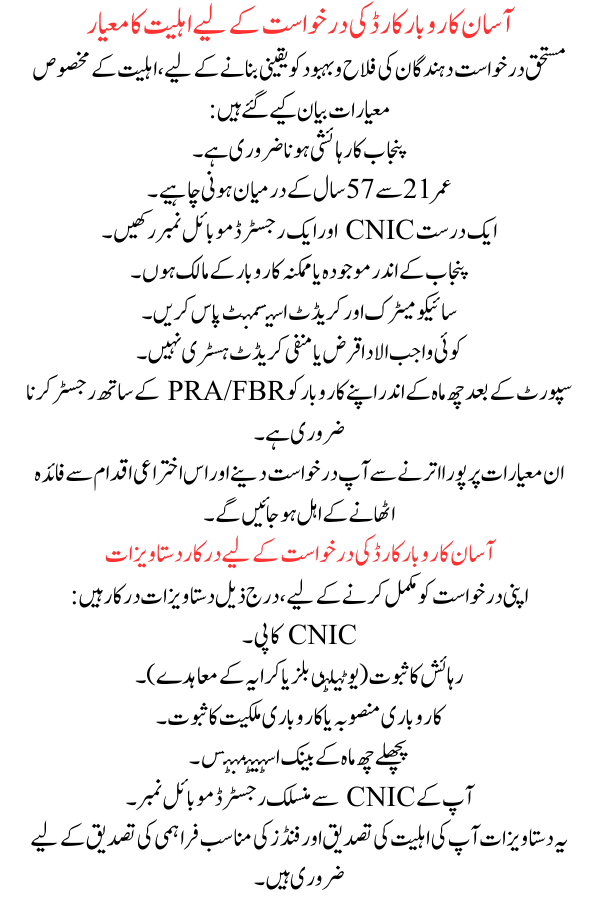

Eligibility Criteria for the Asaan Karobar Card Application

To ensure the program welfares deserving applicants, specific eligibility criteria have been outlined:

- Must be a resident of Punjab.

- Age should be between 21 and 57 years.

- Have a valid CNIC and a registered mobile number.

- Own an existing or prospective business within Punjab.

- Pass psychometric and credit assessments.

- No overdue loans or negative credit history.

- Must register your business with PRA/FBR within six months after support.

Meeting these criteria will make you eligible to apply and benefit from this innovative initiative.

Required Documents for the Asaan Karobar Card Application

To complete your application, the following documents are required:

- CNIC copy.

- Proof of residence (utility bills or rent agreements).

- Business plan or proof of business ownership.

- Bank statements from the last six months.

- Registered mobile number linked to your CNIC.

These documents are essential for verifying your eligibility and certifying the proper provision of funds.

Steps to Fill Out the Asaan Karobar Card Application Form

Applying for the Asaan Karobar Card is a simple process. Follow these steps to acquiesce your application:

- Visit the Official Website: Go to akc.punjab.gov.pk.

- Register Online: Create an account by providing your personal details.

- Fill Out the Application Form: Enter details about your business, including its determination and goals.

- Upload Documents: Ensure all required documents are uploaded in digital format.

- Pay the Processing Fee: Submit a non-refundable processing fee of PKR 500.

- Submit Your Application: Once all facts are complete, submit your application for review.

After submission, your application will be assessed by the worried experts. You will be notified of the approval status via your registered mobile number.

Benefits of the Asaan Karobar Card

The Asaan Karobar Card program offers several key benefits to entrepreneurs:

- Interest-Free Loans: No financial burden from interest payments, making it easier to repay.

- Flexible Repayment Plans: Choose repayment options that suit your cash flow.

- Digital Process: Ensures ease of claim and sooner release times.

- Boosts Business Growth: Enables trades to access capital for growth and novelty.

- Transparency: Guarantees liability in fund provision and usage.

This package is a walking stone for small business owners pointing to thrive in a modest market.

Conclusion

The initial phase to getting interest-free loans that may alter your commercial is to submit the Asaan Karobar Card Application Form. Tycoons’ financial limitations have been fully resolved by the Punjab government’s invention. The Asaan Karobar Card is a useful tool for financial approval because it has a clear online application process, flexible ways to pay, and no hidden fees.

Apply now to get a subsidy for the growth of your business and contribute to Punjab’s growth.

FAQs

What is the maximum loan amount under the Asaan Karobar Card?

The supreme loan total is PKR 1 million.

Is there an age limit to apply?

Yes, applicants must be between 21 and 57 years old.

How can I submit the Asaan Karobar Card Application Form?

You can succumb it online through the official portal: akc.punjab.gov.pk.

What documents are required for the application?

You need a CNIC, proof of residence, business plan, and bank statements.

Is the loan interest-free?

Yes, the loan if through the Asaan Karobar Card is 100% interest-free.