Asaan Karobar Finance Scheme 30M Loan Scheme

Punjab Chief Minister Maryam Nawaz Sharif has hurled the Asaan Karobar Finance Scheme 30M Loan Scheme to support the business community of Punjab. Under this scheme, loans of up to PKR 30 million will be provided to qualified businesses, completely interest-free. This creativity aims to promote entrepreneurship, renovate present businesses, and foster monetary growth across the province. Below is a quick overview of the program:

More Read:Maryam Nawaz Asaan Karobar Card Loan Scheme

| Program Name | Asaan Karobar Finance Scheme |

| Start Date | Ongoing |

| End Date | Not specified |

| Maximum Loan Amount | PKR 30 million |

| Application Method | Online |

Purpose of the Asaan Karobar Finance Scheme

The primary objectives of the scheme are as follows:

- To encourage entrepreneurship and support small to medium-sized enterprises (SMEs).

- To enable individuals to start new businesses.

- To modernize and upgrade existing businesses, eliminating active failings.

- To expand business operations, fostering economic events in Punjab.

- To provide a financial solution for killing business challenges.

Eligibility Criteria of Asaan Karobar Finance Scheme

To qualify for this program, applicants must meet the following criteria:

Business Scale

- Small-scale businesses: Annual sales should not surpass PKR 150 million.

- Medium-scale businesses: Annual sales must range between PKR 150 million and PKR 800 million.

Age Limit

- Applicants must be between the ages of 25 and 55 years.

Tax Compliance

- Applicants must be Federal Board of Revenue (FBR) tax filers with a clear tax best.

Location

- Both the applicant and their business must be based in Punjab, whether the business works from owned or rented lands.

Documentation

Applicants need the following documents:

- Valid Computerized National Identity Card (CNIC).

- National Tax Number (NTN).

More Read:How to Get an Interest-Free Loan

Step-by-Step Application Process

Follow these steps to apply for the Asaan Karobar Finance Scheme 30M Loan Scheme:

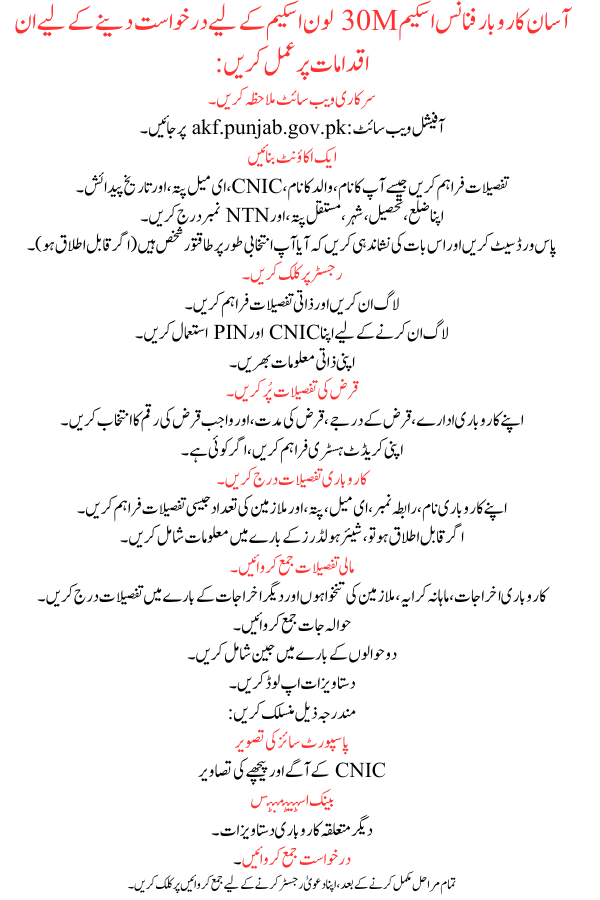

- Visit the Official Website

- Go to the official website: akf.punjab.gov.pk.

- Create an Account

- Provide details such as your name, father’s name, CNIC, email address, and date of birth.

- Enter your district, tehsil, city, permanent address, and NTN number.

- Set a password and indicate whether you are a electorally powerful person (if applicable).

- Click Register.

- Login and Provide Personal Details

- Use your CNIC and PIN to log in.

- Fill in your personal info.

- Fill Loan Details

- Select your business establishment, loan tier, loan tenure, and obligatory loan amount.

- Provide your credit history, if any.

- Enter Business Details

- Provide details like your business name, contact number, email, address, and amount of employees.

- If applicable, include minutiae about shareholders.

- Submit Financial Details

- Enter details about business expenses, monthly rent, employee salaries, and other costs.

- Submit References

- Add gen about two references.

- Upload Documents

- Attach the following:

- Passport-size photograph

- Front and back photos of CNIC

- Bank statements

- Other relevant business documents.

- Submit the Application

- After finishing all steps, click Submit to register your claim.

More Read:Applying for the Karobar Card Loan in 2025

Loan Categories and Details

The Asaan Karobar Finance Scheme 30M Loan Scheme offers two tiers of loans with distinct settings:

Tier I

- Loan Amount: PKR 1 million to PKR 5 million.

- Security: Personal guarantee security.

- Tenure: Up to 5 years.

- Interest Rate: 0% (interest-free).

- Application Fee: PKR 5,000.

Tier II

- Loan Amount: PKR 6 million to PKR 30 million.

- Security: Secured loans.

- Tenure: Up to 5 years.

- Interest Rate: 0% (interest-free).

- Application Fee: PKR 10,000.

Both tiers offer a completely interest-free payment model to ease monetary loads on businesses.

Grace Period for Loan Repayment

To allow businesses sufficient time to stabilize, the scheme runs the following grace periods:

- 6 months for new startups.

- 3 months for business growth or upgrading.

Equity Contribution Requirements

Equity aids are determined based on the loan tier and business type:

Tier II Businesses

- 20% equity contribution for most companies.

- 10% equity contribution for women tycoons and persons with infirmities.

Tier I Businesses and Leased Commercial Vehicles

- 0% equity contribution.

Leased Vehicles

- 25% equity contribution.

Penalties and Fees

- Late Payment Charges: PKR 1,000 per day for behind repayments.

- Handling Fee:

- NIL for new business setups.

- 3% handling fee for Tier II current businesses, counting climate-friendly projects.

Loan Approval and Disbursement

- Applications are reviewed, and eligible applicants are selected through a transparent balloting system.

- Ensure that all mandatory fields are completed to avoid delays or refusal.

More Read:8 Easy Requirements to Get Asaan Karobar Loan Scheme 2025

Frequently Asked Questions (FAQs)

What is the Asaan Karobar Finance Scheme?

The Asaan Karobar Finance Scheme is an creativity launched by Punjab Chief Minister Maryam Nawaz Sharif to provide interest-free loans up to PKR 30 million for tycoons and businesses in Punjab.

Who is eligible to apply for this scheme?

Candidates must be aged between 25 and 55, registered FBR tax filers, and have a business located in Punjab.

What loan amounts are available?

Tier I loans range from PKR 1 million to PKR 5 million, while Tier II loans range from PKR 6 billion to PKR 30 million.

Are the loans interest-free?

Yes, all loans under this scheme are totally interest-free.

How can I apply?

Applications can be succumbed online via the official website: akf.punjab.gov.pk.

What documents are required?

You’ll need a valid CNIC, passport-sized photo, bank declarations, and other relevant commercial documents.

Is there a repayment grace period?

Yes, the scheme offers a grace period of 6 months for new businesses and 3 months for expansion projects.

How are applications reviewed?

Applications are evaluated through a transparent canvassing process.

Are there penalties for late payments?

Yes, a penalty of PKR 1,000 per day will be applied for late refunds.

More Read:Asaan Karobar Card Loan & Asaan Karobar Finance Loan

Summary

The Asaan Karobar Finance Scheme 30M Loan Scheme by Punjab Chief Minister Maryam Nawaz Sharif is a groundbreaking creativity aimed at allowing tycoons and industries in Punjab. By offering interest-free loans of up to PKR 30 million, the program offers a lifeline for starting, updating, and expanding businesses, fostering economic growth across the province. For anyone looking to take their business to the next level, this scheme offers a golden chance.