Asaan Karobar Loan Scheme 2025

The Asaan Karobar Loan Program 2025 is a significant creativity by the Punjab Government aimed at authorizing small and medium-sized enterprises (SMEs) by providing interest-free loans. This scheme is designed to foster free enterprise, stimulate monetary growth, and support business expansion across the province. If you’ve applied for this scheme, it’s essential to know how to check your application status online to stay well-versed about your loan support process.

More Read:Asaan Karobar Scheme Application Fee 2025

Quick Information Table

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

| Asaan Karobar Loan Scheme 2025 | January 2025 | Ongoing | PKR 1 million to PKR 30 million | Online |

Understanding the Asaan Karobar Loan Scheme

The Asaan Karobar Loan Program offers interest-free loans ranging from PKR 1 million to PKR 30 million to support SMEs in Punjab. The loan repayment tenure extends up to five years, with payments structured in easy monthly installments. This initiative aims to remove financial barriers for entrepreneurs, enabling them to start or enlarge their trades without the burden of interest payments.

Key Features of the Scheme

- Interest-Free Loans: Debtors can access large funds without any attention, reducing financial strain.

- Flexible Repayment Terms: Loans are repayable over a period of up to five years in manageable monthly installments.

- Digital Application Process: Applications are succumbed online through the Punjab Information Technology Board (PITB) portal, ensuring a efficient and transparent process.

- Grace Period: A grace period of three months is if from the date of loan payment before repayments begin.

More Read:Easy Business Loans: Apply for Asaan Karobar Card Online

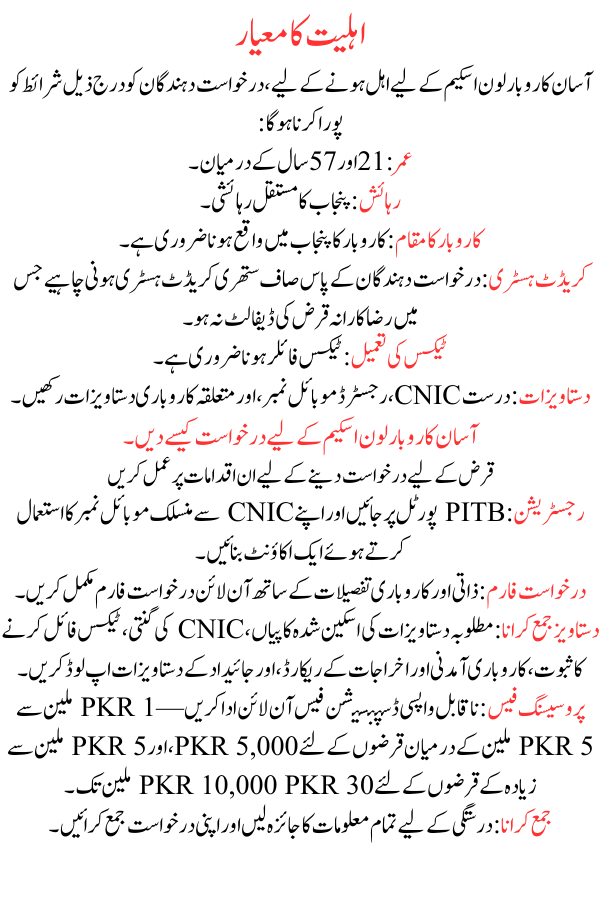

Eligibility Criteria

To qualify for the Asaan Karobar Loan Scheme, applicants must meet the following conditions:

- Age: Between 21 and 57 years.

- Residency: Permanent resident of Punjab.

- Business Location: The business must be located within Punjab.

- Credit History: Applicants should have a clean credit history with no voluntary loan defaults.

- Tax Compliance: Must be a tax filer.

- Documentation: Possess valid CNIC, registered mobile number, and pertinent business documents.

How to Apply for the Asaan Karobar Loan Scheme

Follow these steps to apply for the loan:

- Registration: Visit the PITB portal and create an account using your CNIC-linked mobile number.

- Application Form: Complete the online application form with precise personal and business details.

- Document Submission: Upload scanned copies of the required documents, counting CNIC, tax filing proof, business income and expense records, and property documents.

- Processing Fee: Pay the non-refundable dispensation fee online—PKR 5,000 for loans between PKR 1 million to PKR 5 million, and PKR 10,000 for loans above PKR 5 million up to PKR 30 million.

- Submission: Review all information for precision and submit your application.

More Read:Step-by-Step Instructions for Asan Karobar Sheme Registration 2025

Checking Your Application Status Online

After submitting your application, you can monitor its status through the following steps:

- Access the Portal: Navigate to the official Asaan Karobar Loan Scheme portal.

- Login: Enter your CNIC and the password you created during registration.

- Application Status: Click on the “Application Status” section in your comfort to view the current status of your application.

Possible Application Statuses

- Pending: Your application is under review.

- Approved: Your loan has been authorized.

- Rejected: Your application was declined; reasons will be provided.

- Additional Information Required: Further documents or details are needed to process your application.

Common Reasons for Application Rejection

- Incomplete Documentation: Missing or incorrect documents.

- Ineligibility: Not meeting the specified age, placement, or business location criteria.

- Credit Issues: Poor credit history or existing loan defaults.

- Non-Compliance: Failure to provide tax filing proof or other obligatory information.

More Read:How to Register for Asaan Karobar Card Scheme 2025

Steps to Reapply if Rejected

- Identify the Issue: Review the rejection reason provided in your application status.

- Address the Problem: Gather and correct any missing or untimely information or documents.

- Reapply: Submit a new application through the portal with the efficient material.

Loan Repayment Terms and Conditions

- Repayment Schedule: Refunds begin after a three-month elegance retro and are to be completed in equal monthly outflows over up to five years.

- Usage Restrictions: Loan funds must be used severely for business-related outlays such as vendor expenditures, utility bills, and government fees. Non-business dealings are prohibited.

- Business Registration: Debtors are obligatory to register their business with the Punjab Revenue Skilled (PRA) or Federal Board of Revenue (FBR) within six months of loan approval.

Frequently Asked Questions (FAQs)

How long does the application approval process take?

Applications are naturally processed within 4 to 6 weeks.

Can I reapply if my application is rejected?

Yes, after speaking the reasons for rejection, you can submit a new request.

What happens if I fail to register my business within six months?

Failure to register your commercial within the specified time may result in the annulment of.