Asaan Karobar Scheme Application Fee 2025

The Punjab government’s Asaan Karobar Scheme Application Fee aims to deliver interest-free loans to small and medium-sized initiatives (SMEs), authorizing businesspersons and fostering economic growth. This inventiveness makes it easier for promising and current businesses to access financial assistance and thrive in Punjab. Below, we cover all aspects of the scheme, counting application fees, eligibility criteria, and repayment terms, certifying no further search is required.

More Read:Asaan Karobar Finance Scheme 30M Loan Scheme

Quick Information Table

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

| Asaan Karobar Scheme | January 2025 | Ongoing | PKR 1 million – PKR 30 million | Online |

| Loan Tier | Loan Amount Range | Processing Fee |

| Tier 1 | PKR 1 million to PKR 5 million | PKR 5,000 |

| Tier 2 | PKR 6 million to PKR 30 million | PKR 10,000 |

Loan Tiers and Application Fees

The Asaan Karobar Scheme Application Fee classifies loans into two tiers:

- Tier 1: Loans ranging from PKR 1 million to PKR 5 million with a dispensation fee of PKR 5,000.

- Tier 2: Loans ranging from PKR 6 million to PKR 30 million with a dispensation fee of PKR 10,000.

These processing fees are non-refundable and are vital for the request’s review and valuation process.

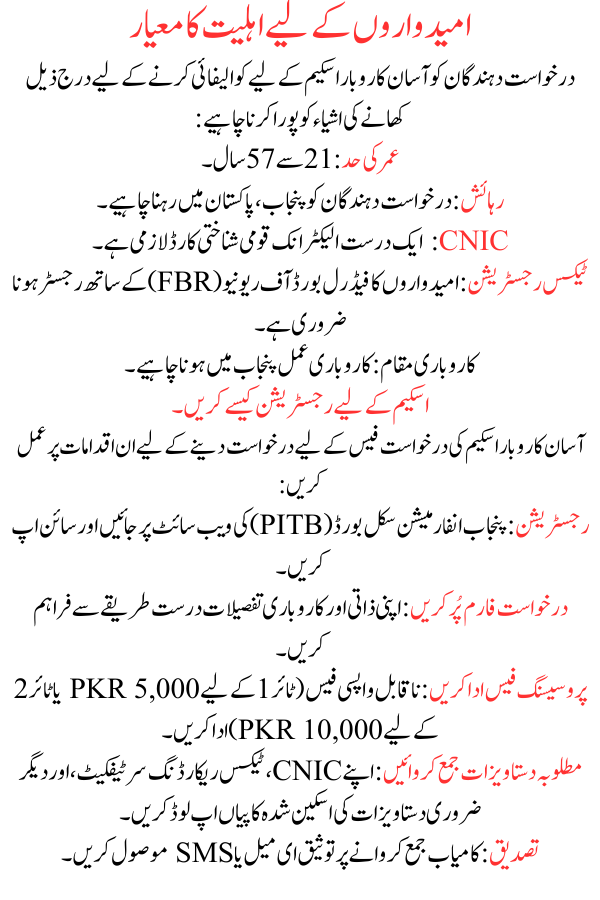

Eligibility Criteria for Candidates

Applicants must meet the following foods to qualify for the Asaan Karobar Scheme:

- Age Range: 21 to 57 years.

- Residency: Applicants must reside in Punjab, Pakistan.

- CNIC: A valid electronic national identity card is mandatory.

- Tax Registration: Candidates must be registered with the Federal Board of Revenue (FBR).

- Business Location: The business processes must be based in Punjab.

More Read:PITB Asaan Karobar Scheme Registration

How to Register for the Scheme

Follow these steps to apply for the Asaan Karobar Scheme Application Fee :

- Registration: Visit the Punjab Information Skill Board (PITB) website and sign up.

- Fill Out Application Form: Provide your personal and business details accurately.

- Pay Processing Fee: Pay the non-refundable fee (PKR 5,000 for Tier 1 or PKR 10,000 for Tier 2).

- Submit Required Documents: Upload scanned copies of your CNIC, tax recording certificate, and other necessary documents.

- Confirmation: Receive a validation email or SMS upon successful submission.

Loan Repayment Terms

The repayment terms for the Asaan Karobar Scheme are flexible and entrepreneur-friendly:

- Interest-Free Loans: Debtors are not charged interest.

- Repayment Period: Loans must be repaid within a all-out of five years.

- Grace Period: Recognized businesses receive a three-month grace period, while startups receive a six-month grace period before repayment begins.

- Minimal Late Payment Penalties: Forfeits for delayed payments are minimal to support borrowers.

- Flexibility: The scheme is intended to lodge tycoons with varying monetary settings.

More Read:Akhuwat Foundation Interest-Free Loan 2025 Online Application

Importance of Processing Fees

The processing fee is a critical aspect of the Asaan Karobar Scheme Application Fee . It:

- Ensures that applications are yielded by serious contenders.

-

Covers administrative expenses for request review and validation.

- Promotes transparency and capability in the evaluation process.

- Helps uphold the quality and competence of the package.

Why the Scheme is Beneficial

The Asaan Karobar Scheme is a groundbreaking creativity for SMEs in Punjab. It delivers financial support without the burden of interest, enabling tycoons to:

- Start new businesses or expand current ones.

- Overcome financial barriers and achieve growth.

- Donate to the local cheap by creating jobs and nurturing innovation.

FAQs

Who can apply for the Asaan Karobar Scheme?

Applicants aged 21 to 57 exist in in Punjab, with valid CNICs and FBR registration, can apply.

What are the loan tiers and processing fees?

- Tier 1: Loans from PKR 1 million to PKR 5 million (Processing Fee: PKR 5,000).

- Tier 2: Loans from PKR 6 million to PKR 30 million (Processing Fee: PKR 10,000).

What documents are required for the application?

Claimants must provide a valid CNIC, proof of tax registration, and pertinent business documents.

What are the loan repayment terms?

Loans are interest-free and must be repaid within five years, with grace periods of three months for established trades and six months for startups.

More Read:Important Documents for the Asaan Karobar Card 2025

Conclusion

The Asaan Karobar Scheme Application Fee is a vital inventiveness by the Punjab rule to empower SMEs and promote economic growth. By providing interest-free loans and transparent request processes, the scheme encourages free enterprise and innovation. With its clear eligibility criteria, structured repayment terms, and minimal request fees, it ensures financial support for both new and established businesses, making it a important step towards financial growth in the region.