Asan Karobar Scheme

The Asan Karobar Scheme is a key initiative by the Punjab government aimed at authorizing small and medium-sized tycoons. Lead by Chief Minister Maryam Nawaz Sharif, the scheme’s primary objective is to provide financial help to SMEs, thereby development financial growth and dipping joblessness in the province.

More Read:Dhee Rani Program Phase 2

Overview of the Asan Karobar Scheme

The scheme offers financial support to tycoons through two main mechanisms:

- Asan Karobar Finance Scheme: Provides interest-free loans to SMEs for business establishment, expansion, and innovation.

- Asan Karobar Card: A digital SME card enabling structured and see-through monetary dealings for small tycoons.

Quick Information Table

| Program Component | Start Date | End Date | Assistance Amount | Application Method |

| Asan Karobar Finance Scheme | Ongoing | N/A | PKR 1 million to PKR 30 million | Online |

| Asan Karobar Card | Ongoing | N/A | Up to PKR 1 million | Online |

Detailed Breakdown of the Scheme Components

-

Asan Karobar Finance Scheme

Objective: To provide financial capitals to SMEs for:

- Founding new businesses.

- Expanding current operations.

- Updating business processes to enhance competence.

Loan Structure:

- Tier-1 Loans:

- Amount: PKR 1 million to PKR 5 million.

- Security: Personal guarantee; no security required.

- Tenure: Up to 5 years.

- Interest Rate: 0%.

- Processing Fee: PKR 5,000.

- Tier-2 Loans:

- Amount: PKR 6 million to PKR 30 million.

- Security: Collateral required.

- Tenure: Up to 5 years.

- Interest Rate: 0%.

- Processing Fee: PKR 10,000.

Grace Period:

- Start-ups/New Businesses: Up to 6 months.

- Existing Businesses: Up to 3 months.

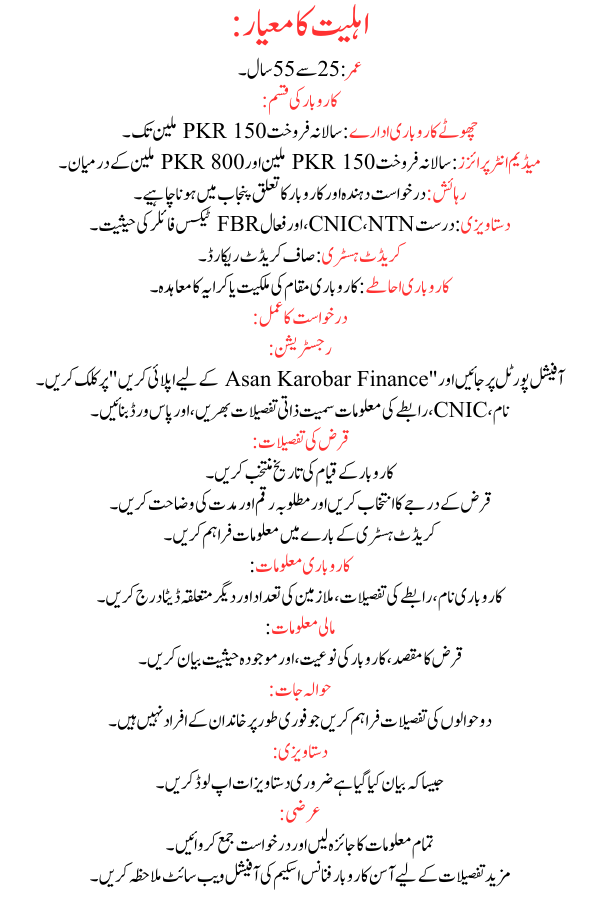

Eligibility Criteria:

- Age: 25 to 55 years.

- Business Type:

- Small Enterprises: Annual sales up to PKR 150 million.

- Medium Enterprises: Annual sales between PKR 150 million and PKR 800 million.

- Residency: Applicant and business must be based in Punjab.

- Documentation: Valid CNIC, NTN, and active FBR tax filer status.

- Credit History: Clean credit record.

- Business Premises: Ownership or rental agreement of the business location.

Application Process:

- Registration:

- Visit the official portal and click on “Apply for Asan Karobar Finance”.

- Fill in personal details including name, CNIC, contact information, and create a password.

- Loan Details:

- Select the date of business establishment.

- Choose the loan tier and specify the required amount and tenure.

- Provide information on credit history.

- Business Information:

- Enter business name, contact details, number of employees, and other relevant data.

- Financial Information:

- Describe the purpose of the loan, nature of the business, and current status.

- References:

- Provide details of two references who are not immediate family members.

- Documentation:

- Upload necessary documents as specified.

- Submission:

- Review all information and submit the application.

For more details, visit the official Asan Karobar Finance Scheme website.

More Read:Wheat Growth Program 2025 Rewards

-

Asan Karobar Card

Objective: To support small tycoons by providing a digital platform for financial dealings, confirming slide and ease of use.

Key Features:

- Loan Amount: Up to PKR 1 million.

- Tenure: 3 years.

- Repayment Structure:

- First 12 months: Revolving credit facility.

- Next 24 months: Equal monthly installments.

- Grace Period: 3 months from card issuance.

- Usage:

- Payments to vendors and suppliers.

- Settlement of utility bills, taxes, and government fees.

- Digital transactions via POS and mobile apps.

- Cash removals (up to 25% of the limit) for business-related expenditures.

Eligibility Criteria:

- Age: 21 to 57 years.

- Residency: Pakistani national residing in Punjab.

- Documentation: Valid CNIC and a mobile number listed in the applicant’s name.

- Business Location: Existing or proposed business must be in Punjab.

- Credit Assessment: Suitable credit and psychometric assessment.

- Credit History: No overdue loans or defaults.

Application Process:

- Digital Submission:

- Applications are submitted online through the Punjab Gen Technology Board (PITB) portal.

- A non-refundable treating fee of PKR 500 is required.

- Verification:

- Digital verification of CNIC, solvency, and business buildings will be conducted by authorized agencies.

- Card Issuance:

- Upon approval, the Asan Karobar Card will be issued, allowing the applicant to access funds and conduct dealings.

For more information, visit the official Asan Karobar Card page.

More Read:Akhuwat Foundation House Loan Scheme

Additional Support and Resources

- Capital Subsidy: Up to PKR 5 million for businesspersons exploiting in solar equipment or eco-friendly technologies.

- Advisory Services: Non-financial optional services to assist in strategic design and business growth.

- Industrial Estates: Development of small manufacturing estates in regions like Sialkot, Gujrat, and Quaidabad, offering reasonable locations for business operations.

- Tannery Zone: Founding of a devoted tannery zone in Sialkot to support the leather industry and address ecological concerns.

- Long-Term Leases: Provision of land leases up to 30 years in industrial estates to facilitate business setup and growth.

Future Plans

The government plans to launch Phase II of the Asan Karobar Scheme in the 2025-26 fiscal year, with a budget of PKR 100 billion. This phase aims to support 24,000 SMEs across Punjab, distributing PKR 379 billion in loans to further rouse financial growth.

More Read:Asaan Karobar Finance Scheme 2025

Conclusion

The Asan Karobar Scheme is a transformative creativity designed to bolster small and medium-sized enterprises in Punjab. By offering financial help, digital deal platforms, and additional support services, the scheme provides a complete framework for tycoons to establish, expand, and update their businesses. Eligible individuals are encouraged to apply and take benefit of the capitals available to turn their business goals into reality.