Asan Karobar Sheme Registration 2025

The Asaan Karobar Scheme Registration is a important initiative by the Government of Punjab aimed at empowering small entrepreneurs by if interest-free loans to provision and expand their businesses. This article offers a complete, step-by-step guide to registration for the Asaan Karobar Scheme Registration in 2025, ensuring you have all the essential info to positively apply.

More Read:Asaan Karobar Finance Scheme 30M Loan Scheme

Quick Information Table

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

| Asaan Karobar Scheme 2025 | January 28, 2025 | December 31, 2025 | Up to PKR 1 million | Online via official portal |

Understanding the Asaan Karobar Scheme Registration

The Asaan Karobar Scheme Registration is designed to offer financial aid to small commercial owners in Punjab. Through this program, eligible tycoons can access interest-free loans of up to PKR 1 million to enhance their business actions. The loan tenure is three years, with a revolving credit ability for the first 12 months and repayment over the following 24 months in equal installments.

Eligibility Criteria

To qualify for the Asaan Karobar Scheme Registration , applicants must meet the following circumstances:

- Residency: Must be a resident of Punjab, Pakistan.

- Age: Between 21 and 57 years old.

- Identification: Possess a valid Electronic National Identity Card (CNIC).

- Mobile Number: Have a mobile number listed in their name.

- Business Location: The business should be located within Punjab.

- Credit History: No previous loan defaults or overdue loans.

- Assessment: Must pass credit and psychometric assessments.

- Application Limit: Only one application per separate and business is allowed.

Meeting these criteria is essential for the application to be considered.

More Read:PITB Asaan Karobar Scheme Registration Now Available Online 2025

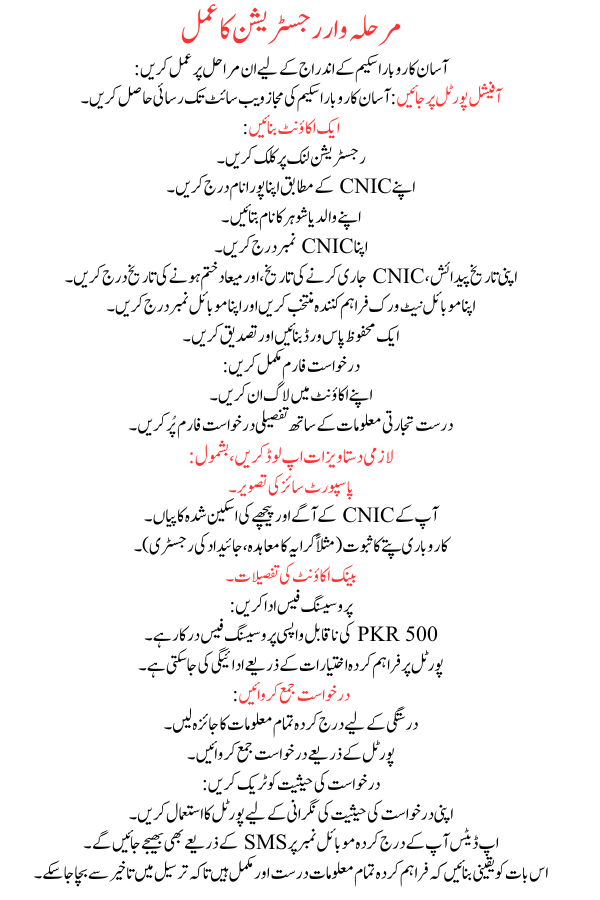

Step-by-Step Registration Process

Follow these steps to register for the Asaan Karobar Scheme Registration :

- Visit the Official Portal: Access the Asaan Karobar Scheme’s authorized website.

- Create an Account:

- Click on the registration link.

- Enter your full name as per your CNIC.

- Provide your father’s or husband’s name.

- Input your CNIC number.

- Enter your date of birth, CNIC issuance date, and expiry date.

- Select your mobile network provider and enter your mobile number.

- Create and confirm a secure password.

- Complete the Application Form:

- Log in to your account.

- Fill out the detailed application form with accurate commercial information.

- Upload the obligatory documents, including:

- Passport-sized photograph.

- Scanned copies of the front and back of your CNIC.

- Proof of business address (e.g., rent agreement, property registry).

- Bank account details.

- Pay the Processing Fee:

- A non-refundable processing fee of PKR 500 is required.

- Payment can be made through the options provided on the portal.

- Submit the Application:

- Review all entered information for correctness.

- Submit the application through the portal.

- Track Application Status:

- Use the portal to monitor the status of your request.

- Updates will also be sent via SMS to your listed mobile number.

Ensure all information provided is accurate and complete to avoid delays in dispensation.

More Read:Important Documents for the Asaan Karobar Card 2025

Benefits of the Asaan Karobar Scheme

The Asan Karobar Sheme Registration offers several advantages to small business owners:

- Interest-Free Loans: Access up to PKR 1 million deprived of any attention charges.

- Flexible Usage: Funds can be used for payments to vendors and dealers, utility bills, government fees, and taxes.

- Grace Period: A three-month grace period from the date of card issuance before repayments begin.

- Digital Transactions: Utilize digital channels like mobile apps and Point of Sale (POS) systems for transactions.

These benefits are designed to support the growth and sustainability of small businesses in Punjab.

Important Considerations

- Single Application: Only one application per individual and commercial is allowable.

- Mandatory Registration: Applicants must register with the Punjab Revenue Authority (PRA) or Federal Board of Revenue (FBR) within six months of card issuance.

- Proper Fund Utilization: Funds must be used solely for business-related activities; non-business dealings are forbidden.

Adhering to these guidelines is crucial for the positive use of the loan.

More Read:Akhuwat Foundation Interest-Free Loan 2025

Conclusion

The Asaan Karobar Scheme Registration 2025 presents a valued opportunity for small businesspersons in Punjab to access interest-free monetary assistance, fostering business growth and economic development. By following the outlined registering process and meeting the eligibility criteria, you can take a important step toward growing your business activities.