Interest-Free Loan Schemes

On behalf of the Government of Pakistan Interest-Free Loan schemes have been introduced so that the public can build a house, start a business, and buy a car Financial assistance can be provided Under these schemes, and interest-free loans are provided so that individuals can meet their needs. In this article Five Major Loan Schemes Full details of, Eligibility, Registration Procedure, and Benefits are described.

Quick Information Table

| Scheme Name | Eligibility Criteria | Loan Amount | Start Date | End Date | Official Website |

| Mera Pakistan Mera Ghar Scheme | Pakistani citizen, CNIC, stable income, property ownership | Up to Rs. 15 lakh | Ongoing | Not announced | SBP Official |

| Asaan Karobar Finance Scheme | Punjab resident, age 21-57 years, FBR taxpayer | Rs. 1 lakh – 3 crore | Ongoing | Not announced | Punjab Govt |

| PM Youth Business & Agriculture Loan | Age 21-45 years, Pakistani citizen, FBR taxpayer | Rs. 5 lakh – 15 lakh | Ongoing | Not announced | PM Youth Loan |

| Pakistan Poverty Alleviation Fund (IFL) | Low-income individuals, aged 18-60 years, residents of targeted areas | Up to Rs. 75,000 | Ongoing | Not announced | PPAF Official |

| Ehsaas Interest-Free Loan Scheme | Low-income individuals must have a small business plan | Varies | Ongoing | Not announced | Ehsaas Program |

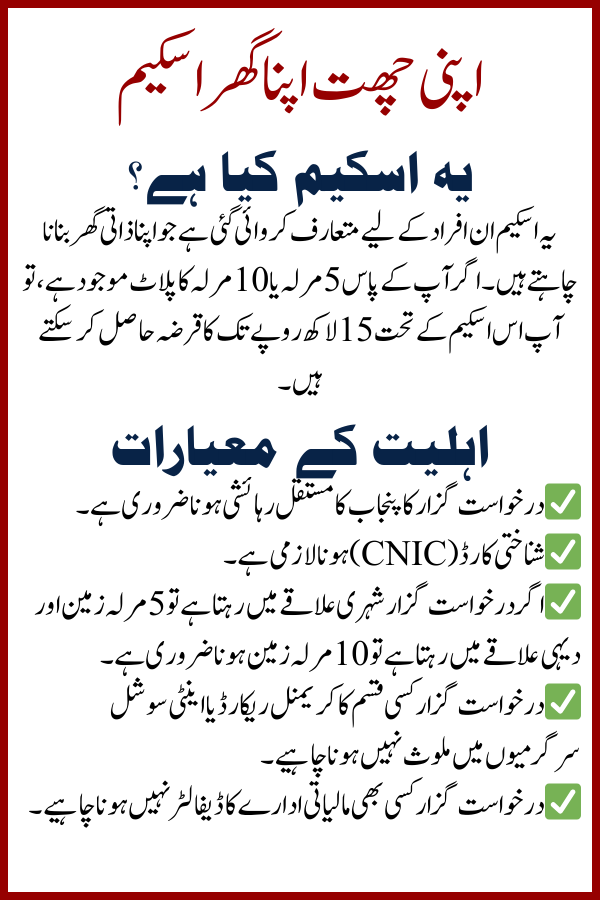

1. Own roof own house scheme

What is this scheme?

This scheme is Introduced for those individuals who want to build their own home. If you have a 5 Marla or 10 Marla plot available, so you under this scheme Loan of up to Rs.15 lakhs can get

Eligibility Criteria

✅ Of the applicant Permanent resident of Punjab Must be.

✅Must have an Identity Card (CNIC).

✅ If the applicant has 5 marla land if living in an urban area And 10 marla land if living in a rural area Must be.

✅The applicant Should not have any kind of criminal record or involvement in anti-social activities.

✅The applicant No financial institution should be a defaulter.

Registration Procedure

- Go to the website and click on the “Register” button.

- Complete the application form.

- Login by entering your ID card number and password.

- Submit the form online.

Benefits

- Interest-Free Loan Schemes up to Rs.15 lakh will be given.

- Petitioner Apna Can build a personal house.

- loan Can be paid back in easy installments.

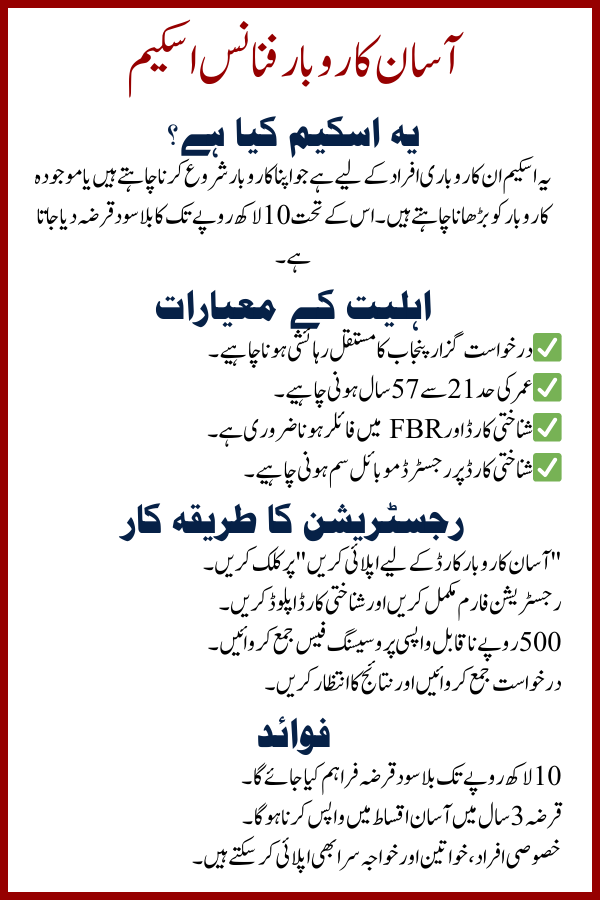

2. Easy business finance scheme

What is this scheme?

This scheme is for those entrepreneurs who Want to start your own business or expand an existing business. Under this Interest free loan up to Rs.10 lakh is given

Eligibility Criteria

The applicant Permanent resident of Punjab Should be.

✅ Age limit of 21 to 57 years should be

✅ID card and more filters must be in FBR.

✅On the identity card Must have a registered mobile SIM.

Registration Procedure

- Click on “Apply for Easy Business Card”.

- Complete the registration form and upload the ID card.

- Submit a non-refundable processing fee of Rs.500.

- Apply and wait for the results.

Benefits

- Interest-free loans up to Rs.10 lakh will be provided.

- loan To be repaid in easy installments over 3 years.

- Special Persons, Women, and Transgender can also apply.

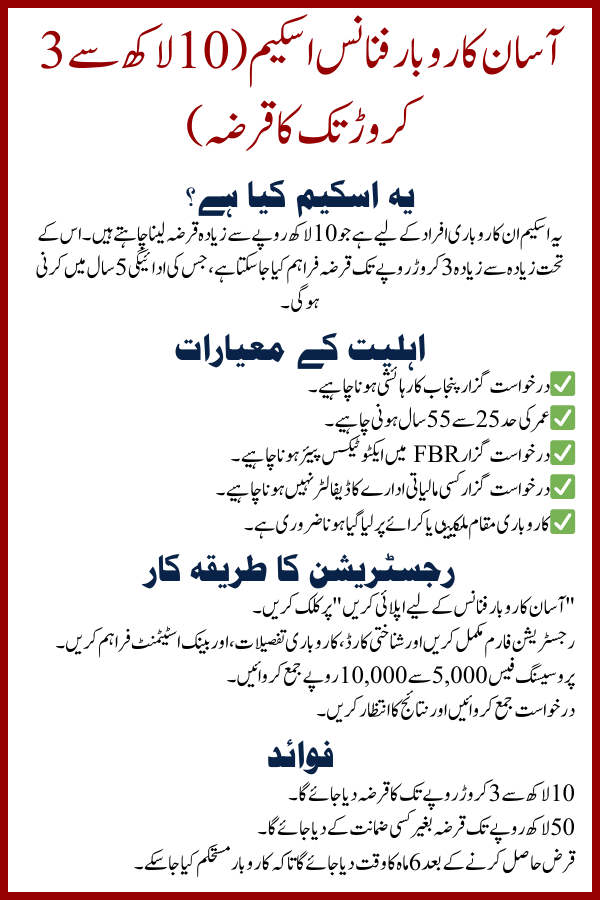

3. Easy Business Finance Scheme (Loan from 10 Lakh to 3 Crore)

What is this scheme?

This scheme is for those entrepreneurs who have Loans exceeding Rs.10 lakhs and want to take Under this Loans up to a maximum of Rs.3 Crores may be provided, payment of which It has to be done in 5 years.

Eligibility Criteria

The applicant Resident of Punjab Should be.

✅ Age limit of 25 to 55 years should be

✅ The applicant’s Active Tax Payer in FBR Should be.

✅ The applicant A financial institution should not be a defaulter.

✅ Business location Must be owned or rented.

Registration Procedure

- Click on “Apply for Easy Business Finance”.

- Complete the registration form and provide ID, business details, and bank statements.

- Deposit a processing fee of Rs 5,000 to 10,000.

- Apply and wait for the results.

Benefits

- A loan from Rs.10 Lakh to Rs.3 Crore will be given.

- Loans up to Rs 50 lakh will be given without any collateral.

- After getting the loan 6 months will be given to stabilize the business.

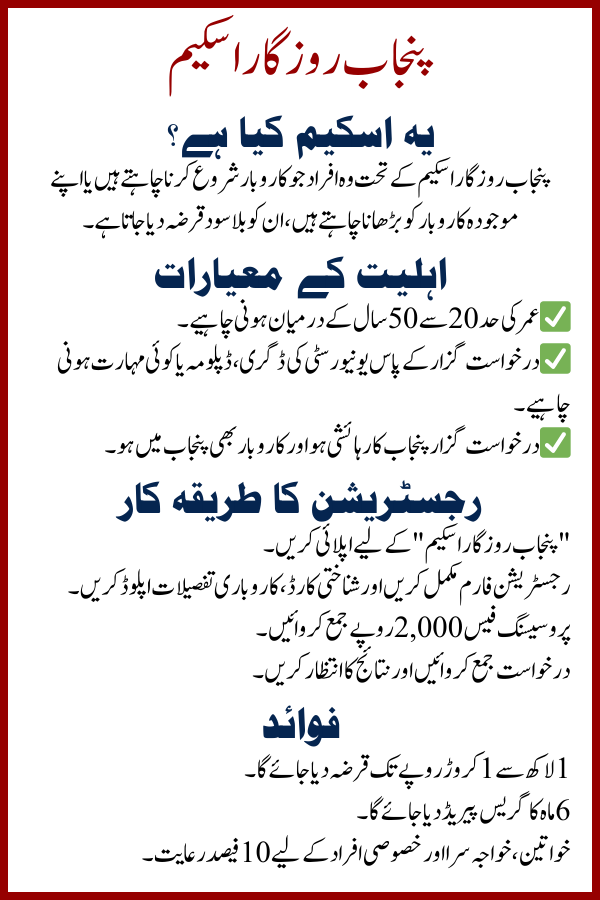

4. Punjab Employment Scheme

What is this scheme?

Under the Punjab Employment Scheme, those persons who Want to start a business or expand their existing business, are given interest-free loans.

Eligibility Criteria

✅ Age limit of 20 to 50 years should be between

✅ To the applicant, a University degree, diploma, or any qualification should be

✅ The applicant Must be a resident of Punjab and the business should also be in Punjab.

Registration Procedure

- Apply for the “Punjab Employment Scheme”.

- Complete the registration form and upload your ID card and business details.

- Deposit a processing fee of Rs.2,000.

- Apply and wait for the results.

Benefits

- 1 lakh to 1 crore will be loaned.

- A grace period of 6 months will be given.

- 10% discount for women, transgender, and special persons.

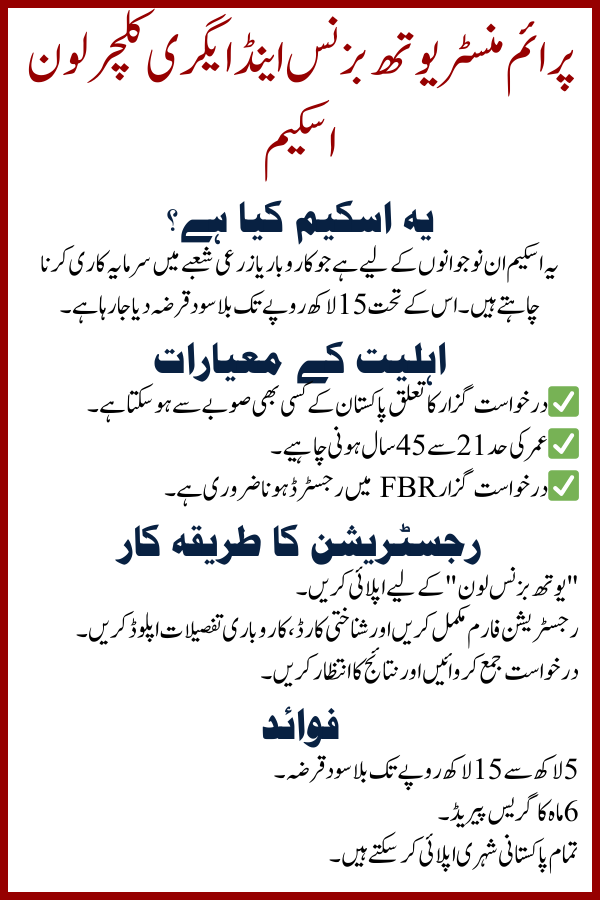

5. Prime Minister Youth Business and Agri-Culture Loan Scheme

What is this scheme?

This scheme is for the youth who Want to invest in a business or agricultural sector. Under this, interest-free loans up to Rs. 15 lakh are being given.

Eligibility Criteria

✅ Relation of the applicant Can be from any province of Pakistan.

✅ Age limit of 21 to 45 years should be

✅The applicant Must be registered with FBR.

Registration Procedure

- Apply for a “Youth Business Loan”.

- Complete the registration form and upload your ID card and business details.

- Apply and wait for the results.

Benefits

- Interest-Free Loan Schemes from Rs.5 lakh to Rs.15 lakh.

- 6-month grace period.

- All Pakistani citizens can apply.

Conclusion

All five of them have Interest-Free Loan Schemes. There are excellent opportunities for those individuals who Want to fulfill their business, home,e or other financial needs. If you If you are eligible then apply as soon as possible.