Karobar Card for Small Business Owners

In a significant move to boost small businesses in Punjab, Chief Minister Maryam Nawaz Sharif has introduced the Karobar Card for Small Business Owners Loan Scheme. This creativity aims to provide fiscal assistance to small tycoons, enabling economic growth and job creation in the area. Complementing this is the Chief Minister Asaan Karobar Financing Scheme, directing medium-sized creativities. These programs underscore the government’s devotion to nurturing free enterprise and speaking economic tests in Punjab.

More Read:CM Maryam Nawaz Sharif Distributes Asaan Karobar Cards

Quick Information Table

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

| Karobar Card Loan Scheme | January 2025 | Ongoing | Up to PKR 1 million | Online |

| Chief Minister Asaan Karobar Financing Scheme | January 2025 | Ongoing | Up to PKR 30 million | Online |

Karobar Card Loan Scheme

The Karobar Card Loan Scheme is intended to support small business owners by offering interest-free loans up to PKR 1 million. This digital SME card ensures structured and clear utilization of funds, enabling tycoons to expand and sustain their trades. The loan tenure is three years, with a rotating credit facility for the first 12 months and repayment over the following 24 months. A grace period of three months from card issuance is if before repayment begins. Funds can be used for vendor and supplier payments, utility bills, government fees, duties, and cash withdrawals (up to 25% of the limit) for miscellaneous business purposes. All transactions are enabled through digital channels such as mobile apps and POS systems.

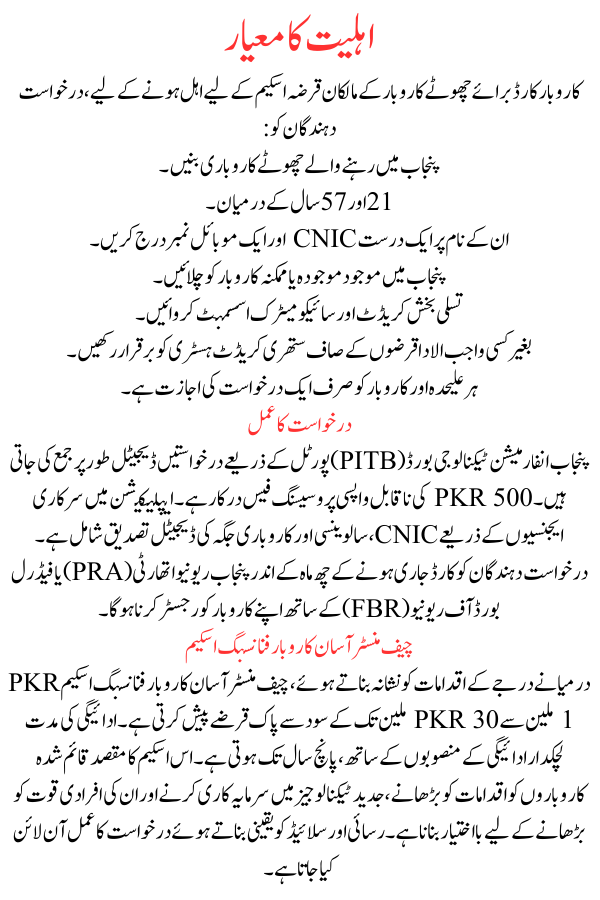

Eligibility Criteria

To qualify for the Karobar Card for Small Business Owners Loan Scheme, applicants must:

- Be small entrepreneurs residing in Punjab.

- Aged between 21 and 57 years.

- Hold a valid CNIC and a mobile number recorded in their name.

- Operate an existing or prospective business located in Punjab.

- Have a satisfactory credit and psychometric assessment.

- Maintain a clean credit history with no overdue loans.

Each separate and business is allowed only one application.

More Read:BISP 8171 Payment Verification Process

Application Process

Applications are submitted digitally via the Punjab Information Technology Board (PITB) portal. A non-refundable processing fee of PKR 500 is required. The application involves digital verification of CNIC, solvency, and business premises by official agencies. Applicants must register their businesses with the Punjab Revenue Authority (PRA) or Federal Board of Revenue (FBR) within six months of card issuance.

Chief Minister Asaan Karobar Financing Scheme

Targeting medium-sized initiatives, the Chief Minister Asaan Karobar Financing Scheme offers interest-free loans ranging from PKR 1 million to PKR 30 million. The repayment period extends up to five years, with flexible payment plans. This scheme aims to empower established businesses to expand actions, invest in modern technologies, and increase their workforce. The application process is conducted online, ensuring accessibility and slide.

More Read:Negahban Program Ramzan Package

Broader Vision for Economic Growth

Chief Minister Maryam Nawaz Sharif stresses that these wits are part of a broader strategy to enhance Punjab’s economic environment. The government aims to create a business-friendly ecosystem that encourages free enterprise and invention. These programs align with other ongoing initiatives, such as the Punjab Free Solar Panel Scheme and the Honhaar Grant Program, all designed to uplift various segments of society.

Importance of Merit and Transparency

A cornerstone of these schemes is the commitment to slide and merit-based allocation. Loans are disbursed based on strict eligibility criteria, ensuring that deserving applicants receive support without political favoritism. This approach fosters public trust and cheers wider participation, maximizing the impact of the programs.

Conclusion

Punjab has made significant strides towards economic empowerment with the Karobar Card for Small Business Owners Loan Scheme and the Chief Minister Asaan Karobar Financing Scheme. These efforts promote free enterprise, innovation, and the creation of jobs by removing the financial barriers that that small and medium-sized enterprises confront. The Punjab government, led by Chief Minister Maryam Nawaz Sharif, is committed to a vibrant and inclusive economy that benefits all citizens.

More Read:Asaan Karobar Finance Scheme

FAQs

What is the purpose of the Karobar Card Loan Scheme?

The scheme provides interest-free loans up to PKR 1 million to small business owners in Punjab, facilitating business growth and economic steadiness.

Who is eligible for the Chief Minister Asaan Karobar Financing Scheme?

Medium-sized initiatives in Punjab can apply for interest-free loans up to PKR 30 million to expand their operations and workforce.

How can I apply for these schemes?

Applications are submitted online through the PITB portal, with a non-refundable processing fee of PKR 500.

What are the repayment terms for these loans?

The Karobar Card for Small Business Owners Loan Scheme offers a three-year tenure with a grace period of three months, while the Asaan Karobar Financing Scheme provides up to five years for repayment.

How does the government ensure transparency in loan allocation?

Loans are awarded based on clear eligibility criteria, with digital verification processes to maintain merit-based and see-through allocation.

Are there any additional support resources for applicants?

Feasibility studies and business development resources are available on the Punjab Small Trades Company (PSIC) and Bank of Punjab (BOP) websites to assist new businesspersons.