Karobar Card Loan

The loan approval process is a dangerous step for persons and businesses seeking financial support. Whether it’s for personal needs, home financing, or business increase, understanding the steps involved can help rationalize the process and improve the chances of success.

This article provides a complete guide to the loan approval process, covering everything from application to payment. It also highlights factors moving loan approval time and tips to speed up the process.

Quick Information Table

| Aspect | Details |

| Process Name | Loan Approval Process |

| Start Date | Upon submission of the loan application |

| End Date | Upon loan approval and disbursement |

| Timeframe | Typically 1–7 business days (varies by lender) |

| Factors Affecting Time | Credit score, document completeness, loan type |

| Application Method | https://akc.punjab.gov.pk/ |

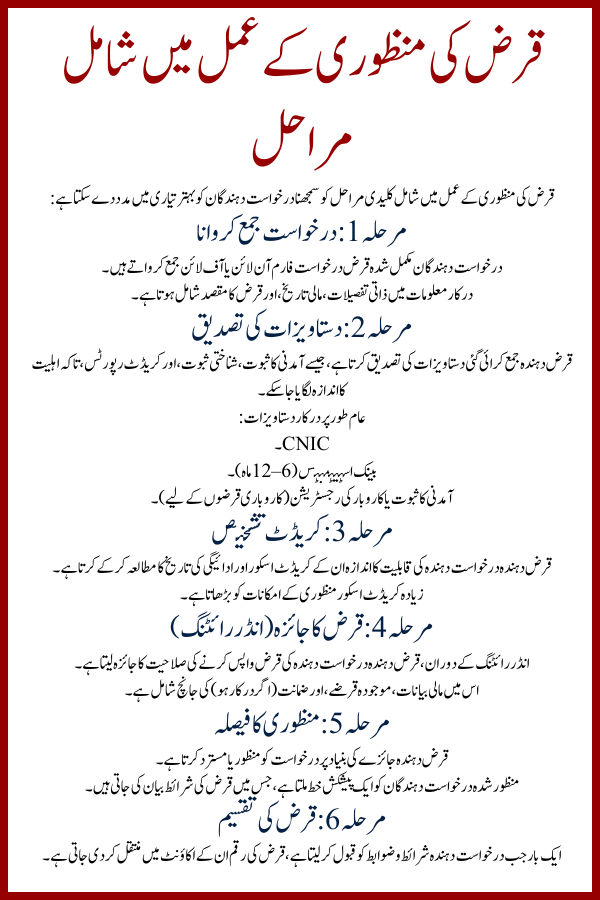

Steps Involved in the Loan Approval Process

Sympathetic the key steps involved in the loan approval process can help applicants prepare better:

Step 1: Application Submission

- Applicants begin by submitting a completed loan submission form either online or offline.

- Required information includes personal details, fiscal history, and loan purpose.

Step 2: Document Verification

- The lender verifies the submitted documents, such as income proof, identity proof, and credit reports, to measure eligibility.

- Common documents required:

- CNIC.

- Bank statements (6–12 months).

- Proof of income or business registration (for business loans).

Step 3: Credit Assessment

- The lender calculates the applicant’s comfort by studying their credit score and repayment history.

- A higher credit score increases the chances of approval.

Step 4: Loan Underwriting

- During underwriting, the lender measures the applicant’s ability to repay the loan.

- This includes calculating financial statements, existing debts, and collateral (if required).

Step 5: Approval Decision

- The lender approves or rejects the application based on the examination.

- Approved applicants receive an offer letter describing the loan terms.

Step 6: Loan Disbursement

- Once the applicant accepts the terms and conditions, the loan amount is disbursed to their account.

- Disbursement can take anywhere from a few hours to numerous days, depending on the lender.

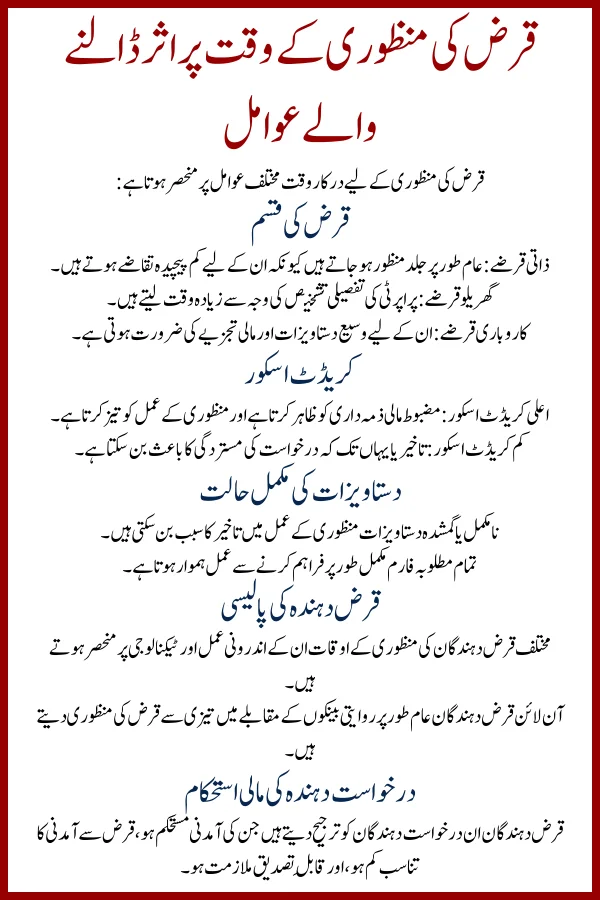

Factors That Affect Loan Approval Time

The time it takes for a loan to be accepted depends on various factors:

- Type of Loan

- Personal Loans: Generally quicker to approve due to simpler requirements.

- Home Loans: Often take longer due to detailed property evaluations.

- Business Loans: Require extensive documentation and financing.

- Credit Score

- A high credit score indicates strong financial accountability and speeds up the approval process.

- Low credit scores may lead to delays or even rejection.

- Document Completeness

- Incomplete or missing documents can delay the approval process.

- Providing all required forms upfront ensures smoother processing.

- Lender’s Policy

- Different lenders have varying approval times based on their internal processes and technology.

- Online lenders typically process loans faster than old-fashioned banks.

- Applicant’s Financial Stability

- Lenders arrange applicants with stable income, low debt-to-income ratios, and demonstrable employment.

Expected Time for Loan Approval

The time required for loan approval varies based on the type of loan and lender:

- Personal Loans:

- Approval Time: 24–48 hours.

- Disbursement Time: Same day to 2 business days.

- Home Loans:

- Approval Time: 5–10 business days (may vary based on property calculation).

- Payment Time: After legal and technical clearances.

- Business Loans:

- Approval Time: 7–15 business days.

- Disbursement Time: Depends on the size and type of loan.

- Student Loans:

- Approval Time: 2–5 business days.

- Disbursement Time: Directly to the organization or applicant.

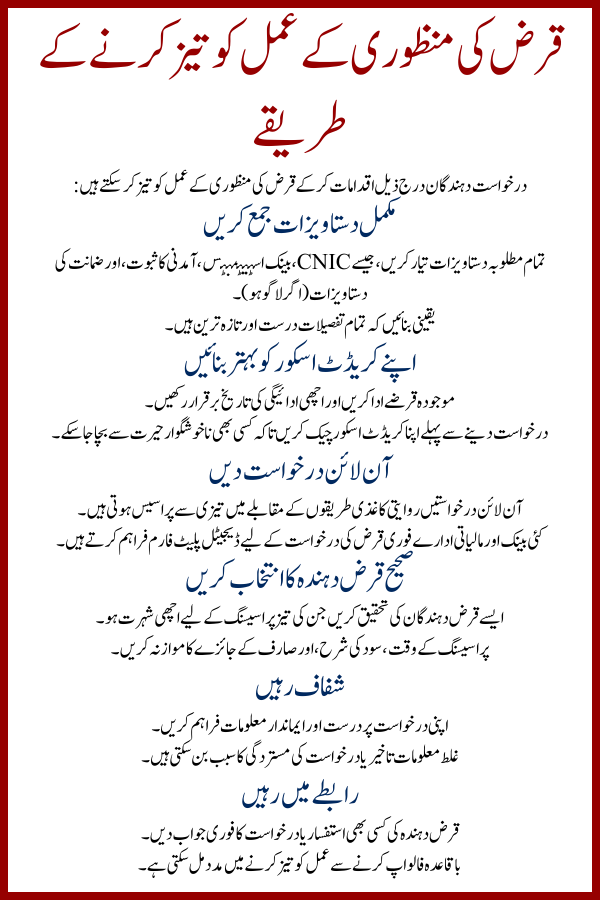

How to Speed Up the Loan Approval Process

Applicants can take the following steps to ensure faster loan approval:

- Gather Complete Documentation

- Prepare all required documents, including CNIC, bank statements, proof of income, and any collateral documents.

- Verify that all details are accurate and up-to-date.

- Improve Your Credit Score

- Pay off existing debts and maintain a good repayment history.

- Check your credit score before applying to avoid surprises.

- Apply Online

- Online applications are processed faster than traditional paper-based methods.

- Many banks and financial organizations offer digital platforms for quick loan applications.

- Choose the Right Lender

- Research lenders with a reputation for quick processing.

- Compare dispensation times, interest rates, and customer reviews.

- Be Transparent

- Provide accurate and honest information on your application.

- Differences may lead to delays or rejections.

- Stay in Contact

- Respond promptly to any inquiries or requests from the lender.

- Regular follow-ups can help expedite the process.

Conclusion

The loan approval process is a crucial step toward locking financial assistance for personal or business needs. By understanding the steps involved, the factors affecting approval time, and strategies to speed up the process, applicants can cross this journey with confidence.

Whether applying for a personal, business, or home loan, preparation is key. Gather the essential documents, improve your comfort, and choose a lender that bring into line with your needs. With the right approach, the loan support process can be smooth and hassle-free.

FAQs

- How long does it take to approve a loan?

Approval times vary based on the loan type and lender. Personal loans may be approved within 24–48 hours, while home loans can take up to 10 business days.

- What documents are required for loan approval?

Common documents include your CNIC, bank statements, proof of income, and, for business loans, business recording documents.

- Can a low credit score delay loan approval?

Yes, a low credit score designates higher risk and may result in delays or rejection.

- How can I check my loan application status?

Most lenders provide online tracking systems or customer service numbers to check application status.

- What can I do if my loan application is rejected?

Examination the rejection reason, improve your credit score, and ensure all documents are complete before reapplying.

- Are online loan applications faster than offline ones?

Yes, online applications are typically processed faster due to streamlined digital systems.

By staying informed and proactive, you can successfully navigate the loan approval process and attain your fiscal goals.