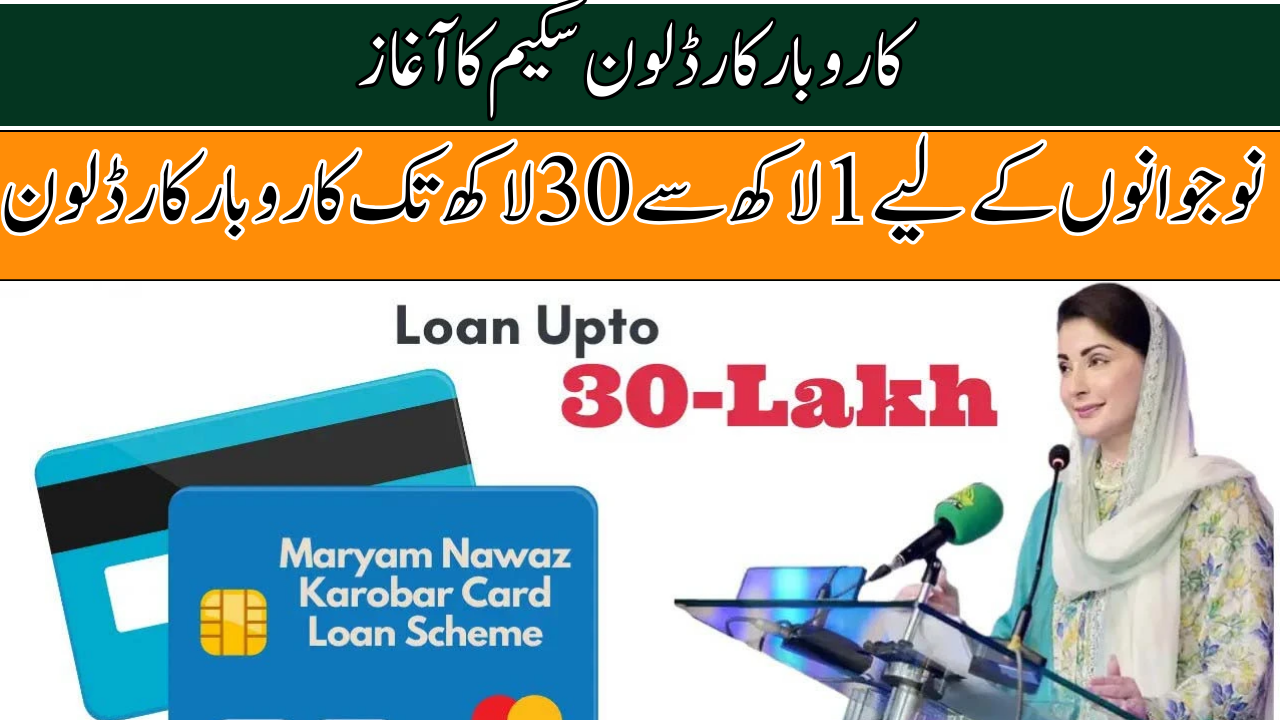

Maryam Nawaz Karobar Card Loan Scheme

The Maryam Nawaz Karobar Card Loan Scheme is an advanced creativity presented by the Punjab government to assist the youth in starting their businesses and undertaking joblessness. This program provides an excellent chance for young Pakistanis to get fiscal support to either start or expand their small and medium-sized businesses. With loan amounts ranging from Rs. 100,000 to Rs. 3,000,000, the scheme aims to invest tycoons by offering interest-free loans and easy repayment terms.

The registration process for this scheme will begin in January 2025. The applicants can submit their requests through an online portal. This scheme also aims to reinforce the economy of Punjab by cheering the growth of small and medium initiatives (SMEs). To ensure fairness and slide, the selection process will be lead via a balloting system, and the victors will be proclaimed shortly after the registration deadline.

More Read:Ramzan Free Rashan Program 2025

Let’s take a closer look at this scheme and how it can benefit aspiring entrepreneurs across Punjab.

Quick Information Table

| Program Name | Maryam Nawaz Karobar Card Loan Scheme |

| Start Date | January 2025 |

| End Date | Not announced yet |

| Loan Amount | Rs. 1 Lakh to Rs. 30 Lakh |

| Method of Application | Online |

Features of the Karobar Card Loan Scheme

The Maryam Nawaz Karobar Card Loan Scheme offers several key features to make it an good-looking option for young entrepreneurs:

Loan Amount Ranges:

- Small Businesses: Loans ranging from Rs. 1 Lakh to Rs. 10 Lakh.

- Medium-Sized Businesses: Loans up to Rs. 30 Lakh.

Interest-Free Loans:

The loan offered under this scheme is interest-free, which is one of the most important benefits. This ensures that young tycoons can focus on growing their businesses deprived of worrying about the burden of paying interest.

Flexible Repayment Period:

The loans can be repaid over a five-year period in easy payments, making it fiscally manageable for borrowers. This long refund period will not cause undue fiscal strain, giving tycoons the freedom to focus on their business growth.

More Read:CM Punjab E-Taxi Scheme 2025

Objectives of the Scheme

The Karobar Card Loan Scheme has several important objectives, aimed at improving the lives of young people and strengthening the economy of Punjab:

- Generating Employment Opportunities: By providing monetary resources to start or grow small businesses, this scheme will help create new jobs across the province.

- Boosting the Economy: Hopeful the growth of small and medium-sized businesses (SMEs) will contribute to the overall economic development of Punjab and Pakistan.

- Empowering Youth: The scheme aims to empower young people, especially the unemployed, by providing them with the monetary resources to become self-reliant and financially autonomous.

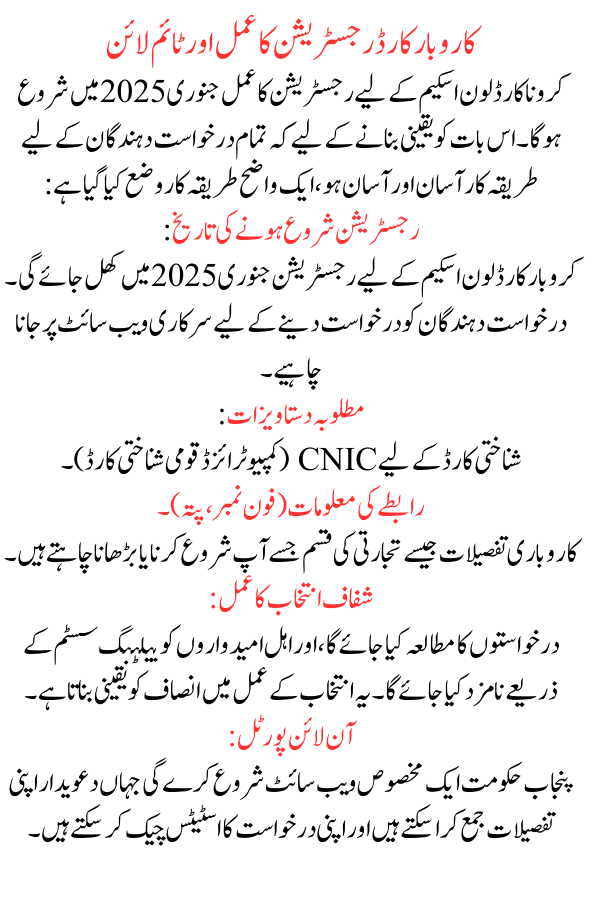

Karobar Card Registration Process and Timeline

The registration process for the Karobar Card Loan Scheme will begin in January 2025. To ensure the procedure is see-through and easy for all applicants, a clear process has been laid out:

Registration Start Date:

- The registration for the Karobar Card Loan Scheme will open in January 2025. Applicants must visit the official website to apply.

Required Documents:

- CNIC (Computerized National Identity Card) for ID.

- Contact Information (phone number, address).

- Business Details such as the type of commercial you wish to start or expand.

Transparent Selection Process:

- Applications will be studied, and eligible candidates will be designated through a balloting system. This ensures fairness in the selection process.

Online Portal:

- The Punjab government will launch a dedicated website where claimants can submit their details and check the status of their application.

More Read:PM Youth Laptop Scheme 2025

Karobar Card Loan Categories

The loan amounts under the Karobar Card Loan Scheme are considered to suit trades of various sizes. These categories are designed to support a wide range of business ventures:

Small Business Loans:

Loans ranging from Rs. 1 Lakh to Rs. 10 Lakh will be if for persons starting small-scale businesses. This amount is ideal for those wanting to start small trade trades, service providers, or other local schemes.

Medium-Sized Business Loans:

For those preparation to expand or set up medium-sized businesses, loans up to Rs. 30 Lakh will be offered. These loans can be used for buying equipment, expanding operations, or investing in business substructure.

Benefits of the Karobar Card Scheme

The Maryam Nawaz Karobar Card Loan Scheme is packed with numerous benefits for young tycoons:

- Interest-Free Loans: By offering interest-free loans, the scheme ensures that entrepreneurs are not loaded with high repayment costs, letting them to focus on growing their trades.

- Job Creation: The creation of new businesses will lead to job chances, helping reduce unemployment and inspiring the local economy.

- Ease of Repayment: With a five-year repayment period, the loans are highly manageable, making them accessible to young entrepreneurs with limited financial resources.

- Empowering the Youth: This scheme authorizes young people by giving them the financial liberty to pursue their dreams of owning and handling a business.

More Read: Punjab Laptop Scheme 2025

Conclusion

The Maryam Nawaz Karobar Card Loan Scheme is a unique chance for jobless youth in Punjab to break free from financial checks and start or grow their own businesses. By offering interest-free loans and a five-year repayment period, the system is designed to support entrepreneurs at various stages of their commercial journey.

Whether you want to open a small shop or start a medium-sized business, this scheme has somewhat for everyone. As the Punjab government works to authorize its youth and boost the economy, this initiative could very well be the key to solving the potential of thousands of wishful tycoons.

Stay tuned for more updates regarding the recording process and eligibility criteria. Visit the official website normally to get the latest material, and don’t miss out on this golden opportunity to convert your corporate idea into a reality.

Frequently Asked Questions (FAQs)

What is the Karobar Card Loan Scheme?

It is a government initiative in Punjab to provide interest-free loans to young tycoons, enabling them to start or increase their small and medium businesses.

What loan amounts are offered?

Loans range from Rs. 1 Lakh to Rs. 10 Lakh for small trades and up to Rs. 30 Lakh for medium-sized businesses.

Is the loan interest-free?

Yes, the loan under the scheme is completely interest-free.

What is the repayment period?

The loans can be repaid over a period of five years in easy installments.

When will the registration process begin?

Registration for the Karobar Card Loan Scheme will start in January 2025.

What documents are required for registration?

You will need to provide your CNIC, contact details, and business information.

How will loan recipients be selected?

The choice process will be carried out through a balloting system to ensure justice.