Maryam Nawaz Loan Scheme 2025

The Maryam Nawaz Loan Program 2025 was launched by the Punjab government, led by Chief Minister Maryam Nawaz Sharif, to promote entrepreneurs and expedite the province’s economic growth. This program provides those who qualify with interest-free loans up to Rs 30 million with the goal of fostering fresh ideas and facilitating the growth of businesses.

More Read:CM Punjab E-Taxi Scheme 2025

Quick Information Table

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

| Asaan Karobar Card Loan | Jan 2025 | Ongoing | Up to Rs 1 million | Online |

| Asaan Karobar Finance Scheme Tier 1 | Jan 2025 | Ongoing | Up to Rs 5 million | Online |

| Asaan Karobar Finance Scheme Tier 2 | Jan 2025 | Ongoing | Up to Rs 30 million | Online |

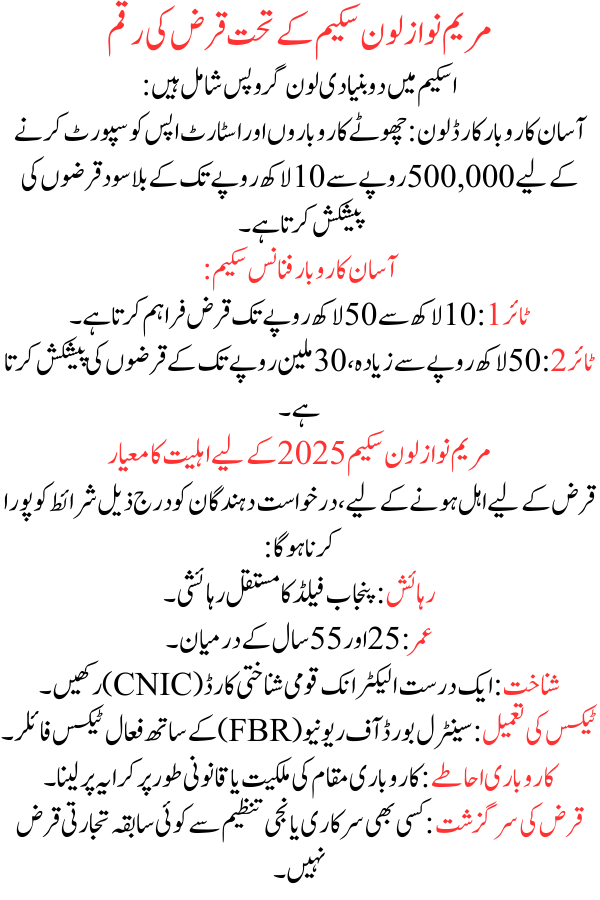

Loan Amounts Under Maryam Nawaz Loan Scheme

The scheme comprises two primary loan groups:

- Asaan Karobar Card Loan: Offers interest-free loans reaching from Rs 500,000 to Rs 1 million to support small businesses and startups.

- Asaan Karobar Finance Scheme:

- Tier 1: Provides loans from Rs 1 million to Rs 5 million.

- Tier 2: Offers loans exceeding Rs 5 million, up to Rs 30 million.

Eligibility Criteria for Maryam Nawaz Loan Scheme 2025

To qualify for the loan, applicants must meet the following conditions:

- Residency: Permanent resident of Punjab field.

- Age: Between 25 and 55 years old.

- Identification: Possess a valid Electronic National Identity Card (CNIC).

- Tax Compliance: Active tax filer with the Central Board of Revenue (FBR).

- Business Premises: Own or legally rent the business location.

- Loan History: No preceding commercial loans from any government or private organization.

More Read:PM Youth Laptop Scheme 2025

Maryam Nawaz Loan Scheme 2025 Details

- Grace Period:

- Asaan Karobar Card Loan: 3 months.

- Asaan Karobar Finance Scheme:

- Tier 1: 6 months.

- Tier 2: 6 months.

- Existing Business Consolidation: 3 months.

- Processing Fee:

- Asaan Karobar Card Loan: Rs 500.

- Asaan Karobar Finance Scheme:

- Tier 1: Rs 5,000.

- Tier 2: Rs 10,000.

Complete Procedure for Registration of Maryam Nawaz Loan Scheme 2025

Attracted applicants can register online by following these steps:

- Visit the Official Portal:

- Asaan Karobar Card Loan: akc.punjab.gov.pk

- Asaan Karobar Finance Scheme: akf.punjab.gov.pk

- Create an Account:

- Enter your CNIC number, mobile number, email address, full name, and set a password.

- Log In:

- Use your CNIC number and watchword to access your account.

- Fill in the Application Form:

- Provide personal details, including name, father’s name, CNIC, address, and comprehensive business information.

- If applicable, include information about business partners.

- Add Business Details:

- Specify the number of employees, monthly income, outlays, and other relevant data.

- Upload Required Documents:

- Attach scanned copies of your CNIC and recent bank account statement.

- Submit Application:

- Review all entered information for accuracy and submit your request.

More Read:Punjab Laptop Scheme 2025

Frequently Asked Questions (FAQs)

What is the Maryam Nawaz Loan Program 2025?

It is an initiative by the Punjab government to provide interest-free loans of up to Rs 30 million to support and promote trades within the province.

What types of loans are available under this Program?

The scheme offers two types of loans:

- Asaan Karobar Card Loan: For amounts between Rs 500,000 and Rs 1 million.

- Asaan Karobar Finance Scheme:

- Tier 1: Loans from Rs 1 million to Rs 5 million.

- Tier 2: Loans from Rs 5 million to Rs 30 million.

What is the grace period for loan repayment?

The grace period varies depending on the loan type:

- Asaan Karobar Card Loan: 3 months.

- Asaan Karobar Finance Scheme:

- Tier 1: 6 months.

- Tier 2: 6 months.

- Existing Business Consolidation: 3 months.

Is there any processing fee for the loan?

Yes, the processing fees are as follows:

- Asaan Karobar Card Loan: Rs 500.

- Asaan Karobar Finance Scheme: