PM Youth Business Loan Scheme

The Prime Minister’s Youth Business Loan Scheme 2025 is an important advantage of the Government of Pakistan aimed at fostering free enterprise among the nation’s youth. By providing subsidized loans, the scheme seeks to empower young individuals to establish or expand their businesses, thereby contributing to monetary growth and job creation.

Quick Information Table

| Program Name | Prime Minister’s Youth Business Loan Scheme 2025 |

| Start Date | Ongoing |

| End Date | Not specified |

| Loan Amount | Up to PKR 7.5 million |

| Application Method | Online |

Eligibility Criteria for the PM Youth Business Loan Scheme

To confirm that the benefits of the scheme reach the most deserving applicants, specific eligibility criteria have been recognized:

- Age Limit: Applicants should be between 21 and 45 years old. For IT and E-Commerce-related businesses, the least age requirement is 18 years, provided the candidate has at least a matriculation or equivalent education.

- Nationality: Only Pakistani citizens holding a valid CNIC are eligible to apply.

- Business Type: Both startups and present small and medium enterprises (SMEs) are eligible. The scheme covers a wide range of sectors, including agriculture, industrial, services, and IT.

- Educational Qualification: For IT/E-Commerce-related businesses, applicants must have at least a matriculation or consistent education.

- Exclusions: Government employees and defaulters of any financial organization are not eligible for this scheme.

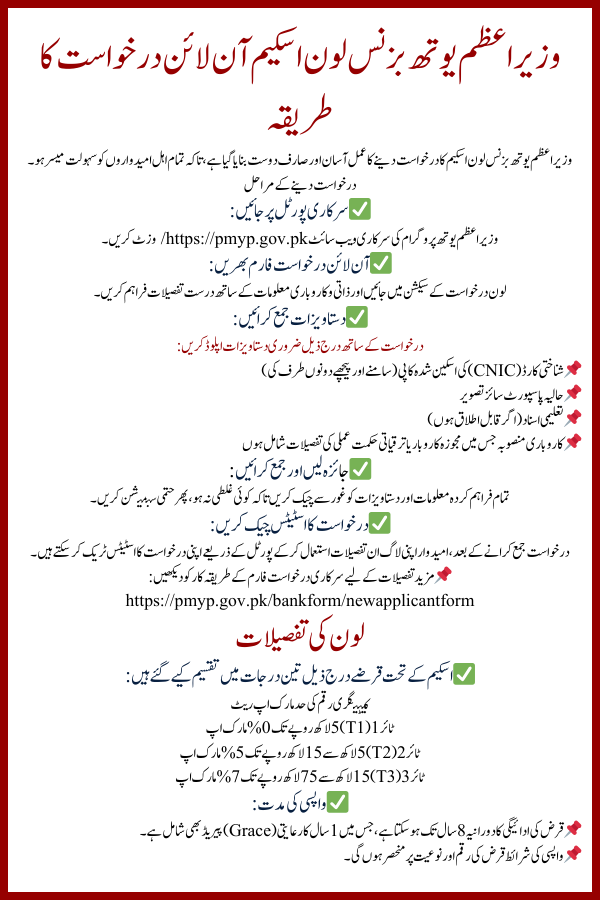

PM Youth Business Loan Scheme Apply Online

The request process for the PM Youth Business Loan Scheme is efficient and user-friendly, designed to facilitate easy access for all potential candidates.

Application Steps

- Visit the Official Portal: Access the Prime Minister’s Youth Program’s official website at https://pmyp.gov.pk/.

- Online Application Form: Revolve to the loan application section and fill out the online form with accurate personal and business information.

- Document Submission: Upload the required documents, which typically include:

- Scanned copies of the candidate’s CNIC (front and back).

- Recent passport-sized photograph.

- Educational certificates (if applicable).

- Detailed commercial plan outlining the proposed venture or growth strategy.

- Review and Submit: Carefully appraisal all entered information and acquiesced documents to ensure accuracy before final submission.

- Application Following: After submission, applicants can track the status of their application through the portal using their login credentials.

For detailed guidance, refer to the official application procedure at https://pmyp.gov.pk/bankform/newapplicantform.

Loan Details

The scheme proposes loans categorized into different tiers, each with exact terms:

- Tier 1 (T1): Loans up to PKR 0.5 million with a 0% markup.

- Tier 2 (T2): Loans above PKR 0.5 million and up to PKR 1.5 million with a 5% markup.

- Tier 3 (T3): Loans above PKR 1.5 million and up to PKR 7.5 million with a 7% markup.

The repayment tenure for these loans can extend up to 8 years, including a grace period of up to 1 year, depending on the loan type and amount.

Last Date to Apply

As of now, there is no specified deadline for requests, and the scheme is ongoing. However, applicants are encouraged to apply promptly, as the availability of funds may be subject to change. For the most current info, regularly visit the official website at https://pmyp.gov.pk/.

Conclusion

The Prime Minister’s Youth Business Loan Scheme 2025 presents a valuable opportunity for Pakistani youth to board on entrepreneurial schemes with the support of supported backing. By meeting the eligibility criteria and following the straightforward application process, aspiring entrepreneurs can access the necessary funds to turn their business ideas into reality, thereby causal to the nation’s monetary development.

FAQs

- Can government employees apply for the PM Youth Business Loan Scheme?

No, government staffs are not eligible to apply for this scheme.

- Is there an age relaxation for applicants with IT or E-Commerce business ideas?

Yes, for IT and E-Commerce-related businesses, the minimum age obligation is 18 years, provided the candidate has at least a matriculation or equal education.

- What types of businesses are eligible under this scheme?

The arrangement supports a wide range of sectors, including farming, manufacturing, services, and IT. Both startups and existing SMEs are qualified to apply.

- How can I check the status of my loan application?

Candidates can track their application status through the official portal by classification in with their credentials. Visit https://pmyp.gov.pk/ for more details.

- Are there any collateral requirements for the loans?

For Tier 2 loans, personal guarantees