Register for Asaan Karobar Card Scheme 2025

The Asaan Karobar Card Scheme 2025, which the Punjab government launched, aims to give the SMEs in the region interest-free loans. By giving loans that spans PKR 500,000 to PKR 10 million, the initiative aims to empower tycoons and promote Punjab’s business and economic growth.

More Read:Akhuwat Foundation Interest-Free Loan 2025

Quick Information Table

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

| Asaan Karobar Card Scheme 2025 | January 16, 2025 | Ongoing | PKR 500,000 to PKR 10 million | Online via PITB portal |

Key Features of the Asaan Karobar Card Scheme

The Register for Asaan Karobar Card Scheme offers several prominent features intended to support tycoons:

- Interest-Free Loans: Loans reaching from PKR 500,000 to PKR 10 million are provided deprived of any interest, making it easier for trades to manage payments.

- Flexible Repayment Terms: Recipients can repay the loan in easy installments over a period of up to five years, with a grace period of three months after card issuance.

- Digital Application Process: Applications are succumbed digitally through the Punjab Information Technology Board (PITB) portal, rationalization the process for applicants.

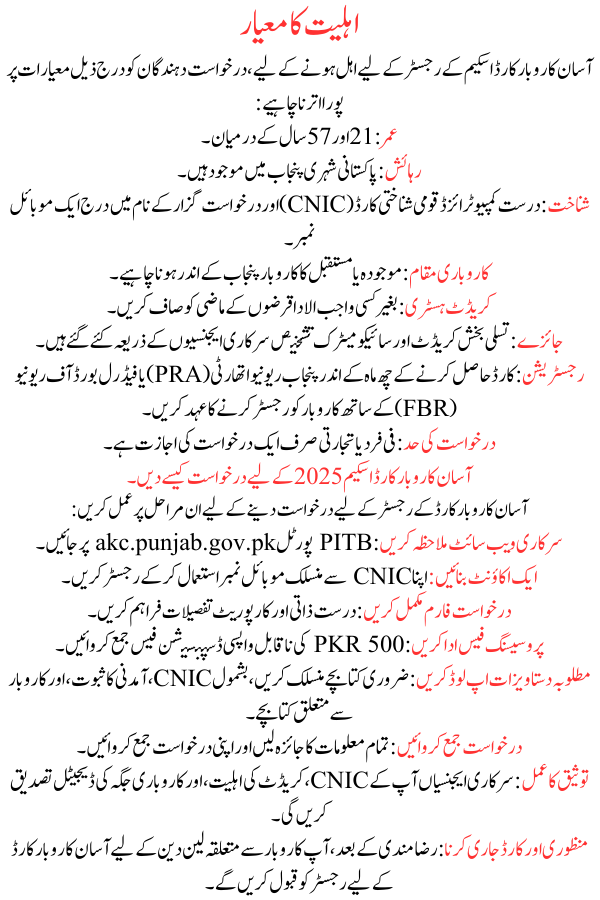

Eligibility Criteria

To qualify for the Register for Asaan Karobar Card Scheme, applicants must meet the following standards:

- Age: Between 21 and 57 years.

- Residency: Pakistani nationals exist in in Punjab.

- Identification: Valid Computerized National Identity Card (CNIC) and a mobile number listed in the applicant’s name.

- Business Location: Existing or future business must be positioned within Punjab.

- Credit History: Clean credit past with no overdue loans.

- Assessments: Satisfactory credit and psychometric valuations conducted by official agencies.

- Registration: Vow to register the business with the Punjab Revenue Authority (PRA) or Federal Board of Revenue (FBR) within six months of getting the card.

- Application Limit: Only one request per individual or commercial is allowed

More Read:.Important Documents for the Asaan Karobar Card 2025

How to Apply for the Asaan Karobar Card Scheme 2025

Follow these steps to apply for the Register for Asaan Karobar Card:

- Visit the Official Website: Go to the PITB portal at akc.punjab.gov.pk.

- Create an Account: Register using your CNIC-linked mobile number.

- Complete the Application Form: Provide correct personal and corporate details.

- Pay the Processing Fee: Submit a non-refundable dispensation fee of PKR 500.

- Upload Required Documents: Attach necessary leaflets, including CNIC, proof of income, and business-related leaflets.

- Submit the Application: Review all information and submit your application.

- Verification Process: Official agencies will conduct digital confirmation of your CNIC, creditworthiness, and business premises.

- Approval and Card Issuance: Upon consent, you will accept the Register for Asaan Karobar Card for business-related transactions.

More Read:Asaan Karobar Scheme Application Fee 2025

Loan Usage and Repayment Details

- Loan Disbursement: The approved loan amount is provided through the Register for Asaan Karobar Card.

- Grace Period: A grace period of three months is granted after card issuance.

- Repayment Schedule: After the grace period, borrowers are required to start paying monthly installments, with a least monthly sum of 5% of the unresolved loan balance (principal portion only).

- Second 50% Limit: Released upon suitable usage, regular repayments, and registration with PRA/FBR.

- Usage Restrictions: Funds are limited to business-related purposes. Non-essential transactions (e.g., personal ingesting, entertainment) are blocked.

- Final Repayment: The remaining balance after the first year is paid over two years in Equal Monthly Installments (EMIs).

Fees and Charges

- Annual Card Fee: PKR 25,000 plus Federal Excise Duty (FED), deducted from the approved loan limit.

- Additional Charges: Includes life assurance, card issuance, and delivery costs.

- Late Payment Penalty: In case of late payment of parts, late payment charges would be recovered as per the bank’s policy/list of charges.

Security Details

- Personal Guarantee: Digitally signed by the borrower.

- Life Assurance: Included in the portfolio.

- Physical Verification: Urban Unit conducts corporeal confirmation of business buildings within six months of loan approval and yearly thereafter.

More Read:Easy Business Loans: Apply for Asaan Karobar Card Online

Key Conditions

- Fund Usage: Limited to core business activities; non-business-related dealings are blocked.

- Business Registration: Obligatory registration with PRA/FBR within six months of card issuance.

- Application Limit: Only one application per discrete/business.

Conclusion

The Register for Asaan Karobar Card Scheme 2025 is a important inventiveness by the Punjab government to bolster economic growth by supporting SMEs. By if interest-free loans with flexible payment terms, the scheme aims to empower tycoons, create service chances, and rouse commercial growth across the area.

Frequently Asked Questions (FAQs)

What is the loan amount offered under the Register for Asaan Karobar Card Scheme?

The scheme offers interest-free loans changing from PKR 100,000 to PKR 1 million.

Is the loan completely interest-free?

Yes, the loan is if at a 0% interest rate.

Who is eligible to apply for this scheme?

Pakistani nationals aged between 21 and 57 years, exist in in Punjab, with a valid CNIC and a listed mobile number, who own or plan to create a commercial in Punjab, are fit to apply.

What is the repayment period for the loan?

The loan has a tenure of three years, with a grace period of three months. Payment is made in 24 equal monthly expenditures after the grace period.